From: https://seekingalpha.com/article/4258754-time-for-gamestop-to-use-konami-code

Summary

- GameStop must utilize the entire $300M share buyback as soon as possible which would save them nearly $50M a year in dividend payouts.

- GameStop should immediately issue a Rule 10b5-1 trading plan that allows them to continue to repurchase shares through the blackout period.

- Earnings per share should top $4.50 in 2020.

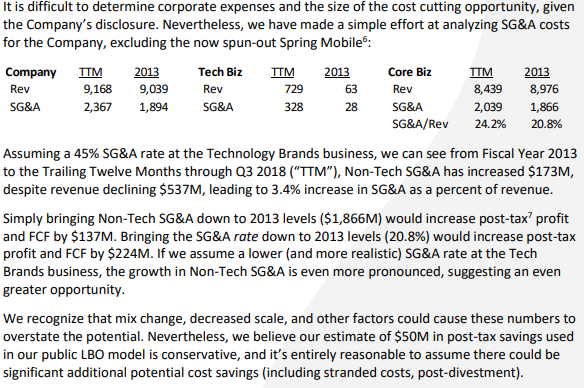

- Management must focus on immediate SG&A savings.

- A rental subscription program would be game-changing.

Thesis

GameStop (GME) can free up nearly $50M in cash a year and increase EPS by over 40% by completing the already authorized $300M share repurchase. GameStop has also announced a $100M net-net profit improvement plan that could increase EPS by $1.00 to $1.40 (depending on the number of shares outstanding). However, GameStop announced they don’t expect the initiative to have a material impact until fiscal year 2020. We believe the improvements can and should be realized much sooner.

Even if net income were set to decline 30% in fiscal 2019 (much worse than any current projections), GameStop could realize an EPS increase of 78% to $3.80 a share if the share repurchase is completed at current price levels and if just $50M in SG&A savings could be realized in fiscal 2019. By fiscal 2020, EPS would top $4.50 on the back of the full $100M net-net profit improvement plan and if multiples expand from 4x to only 10x earnings, shares could top $40.

The Original “Konami Code”

Never heard of the “Konami Code”? The Konami Code, “↑, ↑, ↓, ↓, ←, →, ←, →, B, A, Start, Select” was a cheat code that provided 30 extra lives in the Contra arcade came from the 80’s. Surprisingly, over 30 years later, it remains one of the most well-known cheat codes and lives on in new games as well as in movie references. Why? Because gamers are nostalgic.

There could not be a more fitting connection to GameStop.

While GameStop’s business of physical game sales is under fire and unloved by market participants, gamers (customers) might not see things the same way. The idea that streaming will replace 100% of physical games seems absurd. Gamers are nostalgic. A physical game brings a connection that can not be replaced via digital media. To some degree, streaming or downloading a game is akin to having a collection of photographs on a computer in place of a physical collection of stamps or baseball cards. It’s not the same! Who wants to buy their kid a “download code” for their birthday or for Christmas? It’s not memorable!

We have no doubt the GameStop bears are doubled over in laughter at this point. “Listen to this guy,” they’re saying, “he’s living in a fantasy world, there’s no future for physical games.”

We could reference Redbox, which was bought by Apollo Global Management for $1.6B in 2016 when the market was convinced that streaming would completely replace DVD purchases and rentals. In 2017, it was reported that Redbox had an average of 39 million DVD rentals a month (despite 60% of Redbox users also having a Netflix subscription), and that Redbox would be adding 1,500 kiosks to keep-up with consumer demand. It is unsurprising that Apollo was rumored to have significant interest in purchasing GameStop.

We could reference how survey after survey show the preference for physical games (when it comes to consoles) versus digital games. The most recent edition of Nielsen’s annual US Games 360 Report shows that only 34% of console gamers prefer digital downloads over physical games. When analyzing GameStop it is so important to separate console games from total software sales. As of 2017, it is true that 79% of video game sales are digital and that trend has continued from only 20% in 2009. However, this includes smartphone apps as well as in-game purchases. Similar to someone having a Netflix subscription and using Redbox – just because someone spends money on mobile games and in-game purchases doesn’t have any direct correlation to how much they’re willing to spend on console games. As we noted, of those that purchase console games, 66% prefer physical copies.

A thorough read of the Nielsen survey shows that emotional attachment to physical games and concerns over the longevity of digital purchases top the list of reasons of why console gamers prefer physical copies, not the often-cited storage and speed barriers. Physical games will not disappear in the next decade. That said, internet speeds in rural areas are certainly an issue that will take decades to resolve, further supporting the future of physical games.

The biggest risk to physical game sales are the removal of disc drives from the consoles. Are Microsoft, Sony, and Nintendo really going to produce consoles that prevent a portion of the population from being able to play them at all? We think that seems far-fetched – even ten years from now.

As long as disc drives exist, so will a strong selection of physical games that gamers will continue to purchase and then trade-in at GameStop. In fact, Sony (SNE) already announced that the PS5, likely to be released in 2020, will “still accept physical media; it won’t be a download-only machine. Because it’s based in part on the PS4’s architecture, it will also be backward-compatible with games for that console.” The compatibility news means that demand for used games will continue. There is no chance that Nintendo (OTCPK:NTDOY) and Microsoft (MSFT) will not follow their lead. It is also worth noting the PlayStation 4 has more units sold than the Xbox One, Nintendo Switch, and Nintendo Wii U combined. Given that the last major consoles were released in 2013, we think it’s safe to say the next generation of consoles will buy GameStop another 10 years of solid cash flow.

There is no question; however, 2019 will certainly be challenging as consumers may hold-off on hardware purchases and major software developers hold-off on new game releases in anticipation of the next generation of consoles in 2020.

Fortunately, it simply doesn’t matter for GameStop, because they can just press “↑, ↑, ↓, ↓, ←, →, ←, →, B, A, Start, Select” and more than double their stock.

GameStop’s “Konami Code”

While GameStop’s actual Konami Code is not a sequence of buttons like in the old arcade games, it will be just as effective as someone tripling their lives from 15 to 45 in Contra.

GameStop’s Konami Code is the repurchase of shares.

GameStop has already authorized a $300M share repurchase plan. With the price of GameStop currently trading at less than $9 a share and a market cap of less than $910M, the market is handing GameStop the “power-up” of the decade. If GameStop does not utilize as much of the $300M authorization as possible this quarter there will need to be an immediate change to the board of directors. There are rules for share purchases that, due to the unusually late Q4 earnings report, give GameStop only 20 trading days before the end of Q1 (May 3rd) to repurchase shares. They can only purchase up to 25% of the average daily volume which is currently at 4,458,441 and has been increasing daily. GameStop should have easily been able to purchase at least 1 million shares a day, and with an average share price of around $9.50 they should have utilized at least $190M of the $300M authorization. That is the minimum that shareholders should accept. However, there is no reason that a competent board could not purchase even more.

GameStop needs to immediately issue a Rule 10b5-1 trading plan. This will allow them to make pre-planned purchases that could utilize the entire $300M authorization, even during the blackout period, prior to releasing Q1, 2019 earnings. The board could have also made block trades (once a week) with no limits (such as the 25% rule) on the number of shares included in the block. We notified Investor Relations of this last week and were told that our message was passed along internally.

GameStop ended Q4, 2019 with $1.624B in cash. In early April, $350M was used to pay-off debt maturing late 2019, which leaves GameStop with $1.274B in cash with long-term debt of $471.6M that matures in 2021 with a 6.75% interest rate. As GameStop is a cyclical business, we expect a cash burn of about $700M in the first two quarters of the year before cash accelerates back up in Q3 and Q4. This leaves GameStop with at least $550M in cash that they can use immediately and on top of other significant sources of liquidity.

There is absolutely no reason for GameStop to not utilize the entire $300M authorization. In the next section we will explain why shareholders must push for immediate board changes if significant buybacks are not performed.

Importance of Share Buybacks

GameStop pays a dividend of $1.52 which amounts to an annual cash payout of approximately $155M on 102.27M shares outstanding. If GameStop repurchases $300M worth of shares at an average price of $9.50, they will have repurchased about 31.58M shares, bringing total shares outstanding down to 70.7M.

Why is this so important?

GameStop only has to pay the dividend on the total amount of shares outstanding. Therefore, if shares outstanding are decreased by 31.58M then GameStop retains $48M in cash annually. On a $300M share purchase, this represents a per annum return of 16%. GameStop had free cash flow in 2018 of $232.7M. The amount of cash available for share repurchases or capital expenditures would increase nearly 21% YOY by completing the share buybacks which would also make the remaining dividend payout even more sustainable. If the $48M in saved cash were to be plowed back into annual share repurchases it would continue to provide additional savings each year.

Share repurchases also increase the amount of earnings that flow through to each shareholder. While we do not have any 2019 guidance yet, we can take a look at 2018 to see what the difference would have been. In 2018, adjusted net income was $218.4M which resulted in earnings per share of $2.14 on 102.27M shares outstanding. If shares outstanding were reduced to 70.7M then the earnings per share would have increased to $3.09 (an increase of over 44%), because a greater amount of the net income flows through to each shareholder.

Fiscal 2019, without question, will be a tough year for GameStop, which we will explain shortly. However, even if net income were to fall 30%, to $153M, earnings per share would actually increase to $2.16 year over year, with the share repurchases, before taking into account any SG&A savings.

This logic is predicated on current share prices (which we obviously find far too low). The leverage inherent in buying shares at this price goes away as the price rises, leading to our sense of urgency that management act promptly with respect to share buyback. Put differently, what other investment could generate the kinds of returns we have illustrated, with the kind of confidence associated with investing in your own, well-known, current business?

New CEO

The addition of an outsider as the new CEO, George Sherman, is a welcome development. He has previous experience at Advance Auto Parts, Best Buy, Target, and Home Depot. He must take immediate steps to address pre-owned sales as we will highlight soon. Additionally, we hope he takes immediate steps not only on share buybacks, but also on SG&A costs. As an outsider, we believe he has much greater leverage to accomplish these objectives than the previous CEOs. As we will soon highlight, SG&A is out of control.

eSports Strategy

GameStop has recently announced their foray into eSports with a combination of multiple partnerships. GameStop plans to host hundreds of eSports tournaments nationwide as well as to develop new content to enhance players skills in the games they like to play. In fact, this has already begun online. GameStop intends to bring in a new pro player each month to put on a clinic. April’s clinic is on Fortnite which includes 8 videos on different skills players can master. As you can see from the website, GameStop is leveraging this by encouraging players to purchase digital currency, the Fortnite game and collectibles, as well as accessories related to Fortnite.

We believe this is a solid strategy akin to a well-known Home Depot initiative. Fixer-uppers go to their stores to watch an expert demonstrate how to set tile (or whatever the project is). They then buy not only the tiles, but also the tools and accessories the expert used. We believe that players will watch these videos and will want to own the same accessories as the professionals/teachers they are learning from. GameStop needs to leverage the online piece to also include in-store clinics in addition to the prize-tournaments they are planning. Together, these initiatives should drive sales of other merchandise, physical games, hardware and trade-ins.

Impact of New Console Releases

Microsoft and Sony are expected to release new consoles soon; most expect a 2020 launch, 7 years since the launch of a major new console from either of them. This will hurt 2019 sales, but we expect will be a huge boost to 2020. When the last consoles were released in November of 2013, GameStop’s hardware sales increased by 30% which in-turn led to increases in pre-owned and accessory sales. The next major console cycle will drive significant revenue increases for GameStop.

Historical Sales Mix, Revenues, and Gross Profit

We looked back through each fourth quarter release (such as this example) of revenues and gross profit by category and calculated the percent change from the prior year. These tables we created are shown below (52 weeks ended February 2, 2019 exclude technology brands):

| Net Sales (% Change): | 52 Weeks Ended Feb 2, 2019 | 53 Weeks Ended Feb 3, 2018 | 52 Weeks Ended Jan 28, 2017 | 52 Weeks Ended Jan 30, 2016 | 52 Weeks Ended Jan 31, 2015 | 52 Weeks Ended Feb 1, 2014 | 53 Weeks Ended Feb 2, 2013 | 52 Weeks Ended Jan 28 2012 |

| New Video Game Hardware | -1.3% | 28.3% | -28.2% | -4.1% | 17.3% | 29.7% | -17.3% | – |

| New Video Game Sales | -5.1% | 3.6% | -14.2% | -6.0% | -11.3% | -2.8% | -11.5% | – |

| Pre-owned | -13.2% | -4.6% | -5.1% | -0.6% | 2.6% | -4.1% | -7.2% | – |

| Video Game Accessories | 22.0% | 15.9% | -3.7% | 7.6% | 16.6% | – | – | – |

| Digital | 2.5% | 4.5% | -3.9% | -12.9% | -0.6% | – | – | – |

| Tech Brands, Mobile, Electronics, Other | -17.0%* | -1.8% | 18.5% | 2.1% | 27.6% | -53.2% | 21.2% | – |

| Collectibles | 11.2% | 28.8% | 59.5% | – | – | – | – | – |

| Total: | -3.1%* | 7.2% | -8.1% | 0.7% | 2.8% | 1.7% | -7.0% | – |

*Excludes Technology Brands

| Gross Profit (% Change): | 52 Weeks Ended Feb 2, 2019 | 53 Weeks Ended Feb 3, 2018 | 52 Weeks Ended Jan 28, 2017 | 52 Weeks Ended Jan 30, 2016 | 52 Weeks Ended Jan 31, 2015 | 52 Weeks Ended Feb 1, 2014 | 53 Weeks Ended Feb 2, 2013 | 52 Weeks Ended Jan 28 2012 |

| New Video Game Hardware | -8.0% | 5.8% | -12.1% | -10.7% | 11.4% | 73.5% | -10.5% | – |

| New Video Game Sales | -11.0% | -1.7% | -12.9% | -3.8% | -11.0% | 2.4% | -6.3% | – |

| Pre-owned | -17.1% | -6.4% | -6.3% | -2.8% | 4.8% | -6.5% | -4.2% | – |

| Video Game Accessories | 22.5% | 8.4% | -7.9% | 3.8% | 11.6% | – | – | – |

| Digital | 5.7% | 4.4% | 3.9% | -1.6% | 1.9% | – | – | – |

| Tech Brands, Mobile, Electronics, Other | -18.7%* | 5.5% | 55.4% | 31.2% | 47.4% | -63.7% | 17.3% | – |

| Collectibles | 12.1% | 21.3% | 47.2% | – | – | – | – | – |

| Total: | -7.1%* | 1.0% | 3.1% | 5.1% | 4.3% | 0.4% | -1.0% | – |

*Excludes Technology Brands

What does this show us?

First of all, while not a calculation shown in the tables, 2019 compared to 2013 shows a revenue decline of only 6.8% with gross profit down 13.9%. Interestingly, gross profit at GameStop increased for 5 consecutive years prior to last year! From a revenue and even gross profit perspective, this is hardly a business that is in major decline.

In fact, some of the figures are eye-popping. Video game hardware sales have actually increased 33% from the fiscal year ending in 2013, and they have even increased 2.2% from the fiscal year ending in 2014 which includes the first several months of sales from the last major console releases. Video game accessories have flown off the GameStop shelves and have grown double digits nearly every year with last year representing the fastest growth rate yet at 22%. Better yet, the gross profit for video game accessories increased 22.5% which means that despite a 22% increase in sales, margins actually increased.

In fact, according to this report, 2018 sales of consoles, portable game devices, and accessories totaled $7.5B. This means that GameStop’s hardware and accessory sales of $2.7B represents a 36% market share! Do consumers have other choices? Certainly, but they seem to be overwhelmingly choosing GameStop for these purchases. Clearly, GameStop has a major competitive moat and is a destination store for the purchase of hardware and accessories despite a multitude of other options, including Amazon (AMZN).

GameStop bears rely heavily on the idea that digital downloads and streaming will be the death of the business model. We noted earlier why we don’t think that is true, and an analysis of the numbers show that sales of new video games have declined, but not nearly at a rate proving a mass exodus from physical game sales. In fact, while new video game sales fell 5.1% last year, they are only down a total of 1.8% over the last two years. A 1.8% decrease of new video game sales over two years doesn’t ring any alarm bells for us.

Meanwhile, digital sales have grown the last two years, with margin growth continually outpacing sales growth. The revenue declines for digital for the year ended 2017 are only due to the mid-2017 sale of Kongregate, which was a web gaming portal. While digital makes up a small percentage (7.4%) of total gross profit, when combined with new video game sales the decline over the last two years falls to just 1.1%. We don’t know what percent of digital sales are full-game downloads, but we wonder if the very same game purchased through digital sales is helping offset the decline in new video game sales. Our point is the bears should think more carefully about their assumption that streaming games will disrupt GameStop’s business model. Especially since GameStop’s gross profit margin on digital sales is over 88%.

The Tech brands, mobile, electronics, and other category for the last fiscal year represents primarily Simply Mac sales (since we excluded Technology Brands), and they experienced a collective decline of 18.7% in revenues this past year. Simply Mac sells Apple products and performs Apple certified warranty and repair services. While the decline is large, Simply Mac is the smallest category, and makes up less than 5% of GameStop’s total gross profit.

Collectibles have been a huge bright spot, and key information about 2018 results were very poorly communicated. Collectible sales grew 59.5%, 28.8%, and 11.2% over the last three years. Gross profit margin on Collectibles is also very high, over 32%. Collectibles now represent over 10% of GameStop’s gross profit. GameStop bought the collectibles business in 2015 for $140M. Last year the gross profit on collectibles was over $230M. Clearly, this was a great purchase for GameStop and they expect sales to continue to show double digit growth in 2019.

That said, the growth rate of the Collectibles business revenue appears to be declining, as it fell from 28.8% to 11.2%. However, during the earnings call, Robert Lloyd, the COO and CFO stated:

“Our collectibles business, which now exceeds $700 million in revenue, increased 3.1% in the quarter and 11.2% for the year. Excluding ThinkGeek.com, which is a small piece of the collectibles business and has been restructured due to profitability challenges, our growth would have been 12% for the quarter and 18.3% for the full year.”

In other words, excluding ThinkGeek.com, the gross profit growth rate would have been 18.3% instead of 11.2%, and it has been restructured and will no longer be a headwind going forward. That is at least a $15M difference (probably more) and on 70.7M shares outstanding could add back $0.17 a share, after-tax, in 2019.

We’ve saved Pre-owned sales and gross profit for last for a reason. Clearly, this category has not been performing well lately with a 13.2% decline in revenue and 17.1% decline in profitability from the prior year, which is the largest single-year loss in our review. Pre-owned gross profit makes up 35% of the total gross profit, thus is a significant category for GameStop. The new CEO must determine why pre-owned sales tanked in 2018. GameStop has a 36% market share on hardware and accessory sales, and only minor declines in the sale of new video games. This is not a digital or streaming issue: Buyers are coming into the stores to do an array of other business. Perhaps the eSports initiative will help, but George Sherman’s number one priority aside from share repurchases and SG&A savings should be stabilzing this business. The margin on pre-owned sales is 43%.

Collectibles are a meaningful and growing category that may be set-up to benefit the most from GameStop’s shift to eSport partnerships. Collectible offerings should be a major part of each store and they should also be aligned with the prize tournaments that are being planned. If gamers are heading to a GameStop store for a Fortnite prize tournament, then the manager of that store must make Fortnite collectibles front-and-center and well-stocked the day of the tournament.

This now brings us to the root cause of GameStop’s woes, and it’s not streaming, or digital sales, and certainly not a broken business model. GameStop is not Blockbuster. We’ve disproved all of that by looking at the sales figures as well as market share figures.

So, what is plaguing GameStop?

It is SG&A.

Look at these custom tables we created for SG&A and gross profit less SG&A using the same sources as our other tables:

| SG&A (% Change): | 52 Weeks Ended Feb 2, 2019 | 53 Weeks Ended Feb 3, 2018 | 52 Weeks Ended Jan 28, 2017 | 52 Weeks Ended Jan 30, 2016 | 52 Weeks Ended Jan 31, 2015 | 52 Weeks Ended Feb 1, 2014 | 53 Weeks Ended Feb 2, 2013 | 52 Weeks Ended Jan 28 2012 |

| SG&A (% Change): | -1.1%* | 4.9% | 6.8% | 5.4% | 5.7% | 3.1% | -0.3% | – |

| Gross Profit (% Change): | -7.1%* | 1.0% | 3.1% | 5.1% | 4.3% | 0.4% | -1.0% | – |

| Delta: | 6 pts | 3.9 pts | 3.7 pts | 0.3 pts | 1.4 pts | 2.7 pts | 0.7 pts |

*Excludes Technology Brands

SG&A has increased more and/or fallen less than gross profit, every single year for the last 7 years.

This has resulted in the following declines in gross profit less SG&A:

| Gross Profit less SG&A (% Change): | 52 Weeks Ended Feb 2, 2019 | 53 Weeks Ended Feb 3, 2018 | 52 Weeks Ended Jan 28, 2017 | 52 Weeks Ended Jan 30, 2016 | 52 Weeks Ended Jan 31, 2015 | 52 Weeks Ended Feb 1, 2014 | 53 Weeks Ended Feb 2, 2013 | 52 Weeks Ended Jan 28 2012 |

| Total: | -27.1%* | -10.5% | -6.5% | 4.5% | 0.8% | -5.8% | -2.6% | – |

*Excludes Technology Brands

Look at the decline in the last fiscal year which was made worse by the first gross profit decline in 7 years.

This is a fixable problem and it flies in the face of every bearish argument. GameStop has a SG&A problem. They do not have a sales problem. The business model isn’t broken – management has been broken! This is a break-down in leadership.

GameStop must cut SG&A.

Management recently announced a profit improvement initiative identifying $100M in savings from supply chain efficiencies, operational improvements, and pricing and promotion optimization. The majority of the focus appears to be on indirect costs such as shipping and supply costs rather than on cost cutting. Management will be providing more detail in the coming quarters, but the majority of the $100M in annual savings is currently expected to not hit until the next fiscal year.

This is a great start, but it does not go nearly far enough. Hestia Capital recently published a letter stating:

Since the letter, Hestia Capital, Permit Capital, and GameStop have come to an agreement that included GameStop adding two new independent directors with one of the directors having been selected from recommendations put forth by Hestia Capital and Permit Capital.

While we applaud the effort by Hestia Capital and Permit Capital, if management does not take immediate action to utilize the entire $300M share buyback authorization or to make meaningful and immediate SG&A cuts we believe shareholders should take further action.

Short Positions

There are currently 41.268M GameStop shares sold short on only 102.27M shares outstanding. If GameStop completes the share buybacks there will only be approximately 70M shares outstanding. If GameStop were to complete the share repurchase authorization, they could immediately issue a new $300M share repurchase authorization. A second $300M share repurchase authorization at current prices would take shares outstanding below the level of shares held by short sellers. This announcement (even if a single share is never purchased with the second authorization) would result in an epic short squeeze that could potentially push shares well above the 52-week high of $17.27.

2019 Guidance

Management did not provide 2019 earnings per share guidance since the new CEO had not started yet, and because they expect to release more details around the cost savings and profit improvement initiative. They did state that they expect 2019 revenues/comparable store sales to fall 5% to 10% due primarily to the reasons we stated earlier. The new console releases are not expected until 2020 which will lead consumers to hold off on hardware purchases and software developers are not planning any major game releases in 2019.

The revenue guidance led to GameStop shares plummeting even further in April. However, we believe the market is overreacting. GameStop profitability is less about revenue and more about sales mix. If the revenue declines are coming from new video game sales and hardware, we are talking about categories that have gross margins of only 8% to 22%. Management stated that they expect doubt digit sales growth in collectibles which we noted earlier has gross margins of over 32%. Management also expects continued growth in accessories which have a gross margin of over 32% as well. Therefore, the biggest question mark is the performance of the pre-owned category.

We believe pre-owned sales could be stabilized with management attention, and that the majority of the anticipated revenue decline will be in video game sales and hardware. The result of the shift in sales mix along with more timely SG&A decisions could result in an increase in 2019 profitability despite revenue declines. The revenue declines will likely reverse in 2020 with the release of the new consoles.

PowerUp Rewards Program and Rental Subscriptions

We believe that part of the reason for GameStop’s market share dominance is due to the PowerUp rewards program. According to the most recent 10-K GameStop has approximately 40M PowerUp Rewards members in the US and 21M internationally. A large reason for Best Buy’s (BBY) success is due to price matching and rewards. People purchase TVs from Best Buy instead of Amazon, because they can make the purchase at the same price plus get Best Buy rewards that can be used to save money on additional items at Best Buy. GameStop PowerUp rewards members do the same thing. There’s a reason why GameStop has a 36% market share when it comes to hardware and accessories. If GameStop could leverage this competitive advantage with a rental subscription program it would be very powerful. Why would a person want separate subscriptions with separate software developers/console manufacturers when they could just have one single subscription with GameStop that includes all platforms that also gives them rewards cash to spend on hardware, accessories, collectibles, and digital currency?

In October of 2017 GameStop announced a video game rental program called PowerPass that appeared to have a lot of traction before it was pulled a few months later right before it was about to be released. It was unclear why it was pulled, but rumors hinted towards an antiquated point-of-sale system that could not handle the program. We recently spoke to Investor Relations regarding the approximately $100M annual spend in “purchase of property and equipment” since this constitutes nearly 30% of operating free cash flow. While a lot of the spend was on lease-hold improvements such as display structures and signage they also mentioned that the spend has been on point-of-sale systems. If that means the point-of-sale systems could now handle a rental program then that would be an absolute game-changer for GameStop! If RedBox is successful selling DVD rentals, then GameStop should be able to have a successful subscription rental program.

A rental program would be huge for GameStop for a number of reasons. First, it would bring customers to the store much more often which may result in increased purchases of collectibles, accessories, and digital currency. Second, it would create a base revenue stream for GameStop that would help to reduce the seasonality of the business while also increasing predictability of revenue and profit and markets love predictability. An announcement of a rental subscription plan would completely change investor sentiment.

Valuation

GameStop announced the completion of the sale of Spring Mobile for $700M on January 16, 2019. Based on year-end financials excluding that category (Technology Brands), we can identify that in 2018, technology brands accounted for $677.50M in revenue, $555.20 in gross profit, and $101.80 in gross profit less SG&A.

GameStop sold Spring Mobile for essentially 7x net profit. We believe GameStop obtained an excellent price as there were some valuations that pegged Spring Mobile as having no value at all. With the decline in share price, the value of the sale has increased extraordinarily as long as GameStop reinvests it in share buybacks while the stock is at this level.

As highlighted earlier, even if we assume a beyond-worst-case scenario of a 30% decrease in 2018 net income from $218.4M to $153M – a $300M share repurchase at current levels would result in a YOY increase to EPS of $0.02 to $2.16. If just $50M in post-tax SG&A savings could be realized in fiscal 2019 the EPS would increase to $3.80 (a 78% increase from 2018) even if net income drops 30%!

Revenues and net income should grow in 2020 with the first major console release in 7 years which, combined with another $50M in post-tax SG&A savings would drive EPS over $4.50 in fiscal 2020. If GameStop is not able to realize any SG&A savings in 2019 it ultimately has no impact to our 2020 estimate of $4.50 as long as the full $100M is realized in 2020 as guided, and the entire $300M authorization is utilized while the stock is trading under $10. Even if GameStop’s multiple of 4x earnings doesn’t improve, the share price would approach $18 a share. However, we think a 4x multiple in such a scenario is highly unlikely and a likely improvement to just 10x would result in shares topping $40. If GameStop can show that their eSports initiative can stabilize gross profit then both earnings as well as the earnings multiple could rise even further.

The dividend currently represents a 15% yield, and we expect management to keep the dividend in place. It should be readily payable if shares are repurchased and SG&A costs are decreased. We would accept the decision to cut the dividend only if 100% of the cash savings were to be used to repurchase shares, but we do not feel that any changes to dividend policy are necessary.

Conclusion

GameStop appears to be heading in the right direction, but must go beyond good ideas to immediate action. The announcement of the $300M share repurchase had no time commitment behind it, yet the faster the purchases are executed the greater the annual cash savings. Management should make immediate cuts to SG&A, as there is no reason why $50M in SG&A improvements could not be realized in fiscal 2019.

Acquisitions should be completely off the table.

GameStop should consider subscription/rental services to turnaround the pre-owned category. Perhaps the service could even be offered for new games.

Management should promptly issue a Rule 10b5-1 trading plan that allows them to continue repurchasing shares throughout the blackout period.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Value, Deep Value, Contrarian, Special Situations

Contributor Since 2019

Disclosure: I am/we are long GME. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: GME currently represents the third largest position in the DOMO Concentrated All Cap Value Composite. More information on the composite can be found at our website. DOMO Capital Management, LLC (“DOMO”) is a Wisconsin-registered investment adviser. Justin R. Dopierala is the President and Founder, and a registered investment adviser representative, of DOMO. Additional information about DOMO is disclosed in our Form ADV, which is available upon request. All information contained herein is for general informational purposes only and does not constitute a solicitation or an offer to provide investment advisory services in any jurisdiction. The investment strategy discussed herein may not be suitable for everyone. Investors need to review an investment strategy for their own particular situation before making any investment decision. We believe the information obtained from any third-party resources to be reliable, but we do not guarantee its accuracy, timeliness or completeness. The opinions, estimates, projections, comments on financial market trends and other information contained herein constitute our judgment and are as of the date of the material, are subject to change without notice at any time in reaction to shifting market conditions and other factors and should not be construed as personalized investment advice. DOMO has no obligation to provide any updates or changes to such information.