All capital markets went way down last week, and now they all went way back up.

But really, the valuations of things haven’t changed by much. And we’re again at or near ATH. And then some companies went down but didn’t go back up.

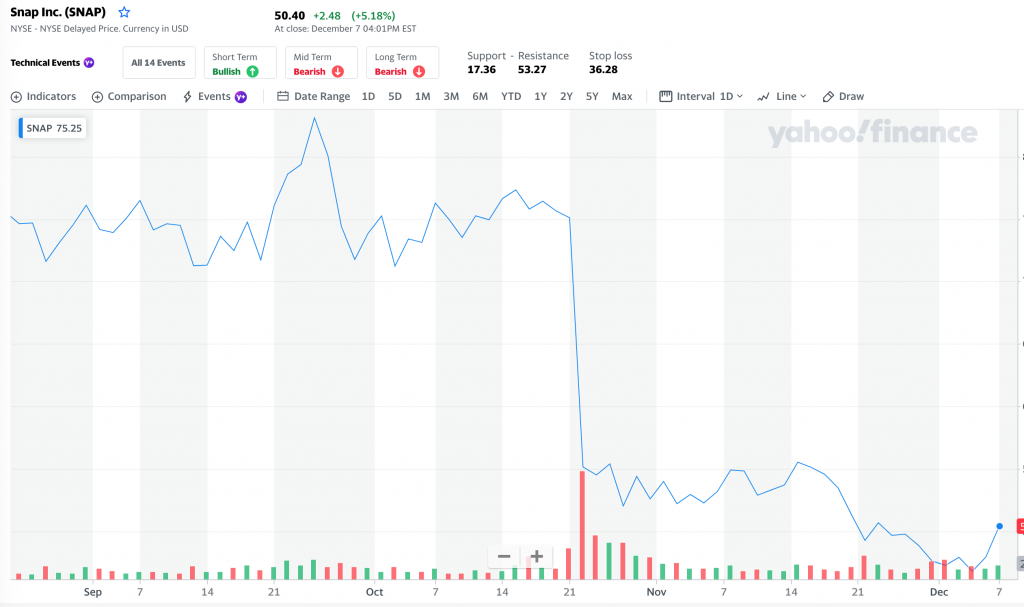

Well, SNAP went down for a different reason, Apple (AAPL) updated their privacy policy to require asking users permission to track them for advertisement purposes. So naturally nobody gave permission, and SNAP could not deliver personalized ads, resulting in poorer RPM (rate per million) ad impression, lost profits, the expectation of reduced profits, etc.

But here is another one:

Salesforce (CRM), is it going back up or staying where it is? Very exciting.

Anyway, regarding the flash crash. I wonder if specific baskets of companies had to be eliminated and converted to cash. To pay for something like GME. And the margin calls will be ongoing, not only because apes are holding and ain’t fuken leavin’, but additionally because they’re actively DRS’ing!

Meanwhile, the US Government is printing money non-stop, magically and miraculously keeping things afloat, at least for them. I wonder if values will continue being pumped up, and whatever will happen when it finally pops – cause it can’t be kept under 180 forever. Slow burn-up would be ideal. So buy and hold, then. NFA

But the flash-crash teaches you something, about volatility. That you could ride it. Of course, then the market turns on you and you lose all your money, but that’s another story. Ahem. I’m sure smart people make a lot of money on this.