From: https://news.investorturf.com/finra-congress

FINRA Corruption

The Financial Industry Regulatory Authority is under pressure as new email transcripts emerge exposing the corruption in the stock market. FINRA currently has multiple lawsuits filed against them for Security Fraud in the State of Florida, and California. Congress has made an official request to FINRA for the MMTLP blue sheets, and investors are getting the FBI involved. The new email transcripts prove that FINRA was aware of fraud in a security and the regulator authority allowed it to trade for over a year. This new evidence destroys trust in FINRA, and the S.E.C. since they’re not protecting investors, and companies.

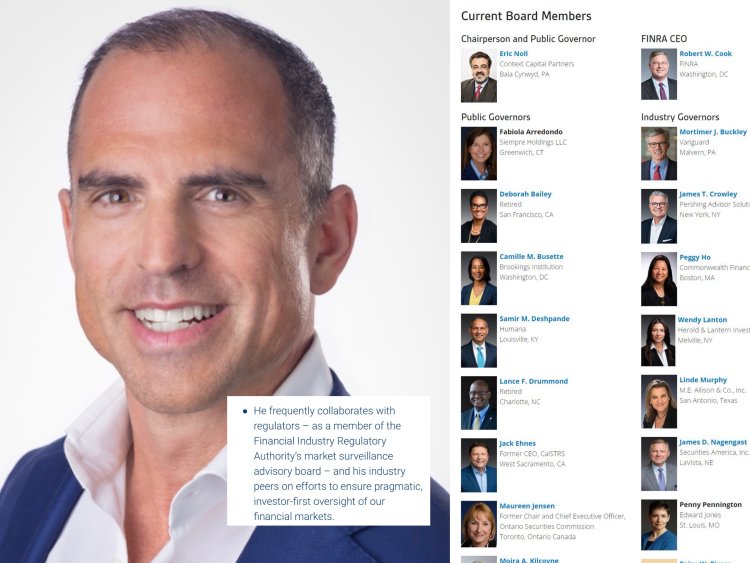

FINRA is a government-authorized not-for-profit organization that oversees U.S. broker-dealers. The organization states they “undertake efforts to protect the investing public against fraud and bad practices” although it seems like they’re the ones committing fraud. FINRA’s board includes Hedge Funds, and Market Maker. According to GTSX website the CEO of Global Trading Systems (GTS) Ari Rubenstein is on the board of FINRA. GTS is the first market maker that appeared when MMTLP first became tradable in October of 2021. Investors are asking why there are bad actors, hedge funds, and market makers on the board of FINRA.

Ari Rubenstein on FINRA’s market surveillance advisory board along with hedgefunds and banks

Congressional Investigation Letter

A Congress member is requesting the blue sheet data from FINRA for MMTLP, and a Congressional investigation letter was recently sent to the CEO of Meta Materials Inc. George Palikaras by Congress member Pete Sessions. Mr. Sessions states the U.S. House Financial Service Committee, the U.S. House Oversight and Accountability Committee, and his office is gathering data that will be helpful in oversight analysis, protecting investors, and potential legislative efforts to reform Regulation SHO and Naked Short Selling rules.

The Congress member states there have been issues with FINRA; “Several issues have been brought to my attention surrounding the trading and ultimately the U3 Halt issued by FINRA on ticker symbol MMTLP. It is my understanding in talking with FINRA personally, that there has been a “hiccup” in the matter and that there may be short positions that have not settled in the trades of MMTLP. Furthermore, the CEO of OTC Markets has also publicly stated that there are indeed short shares that are trapped because of the FINRA halt”

Pete Sessions mentions large shareholders have hired Wes Christian that is gathering information and MMTLP data, and is asking Mr. Palikaras corporation in this process. Sessions states; “We believe this data will give us insight into any potential violations of securities laws by outside actors and may potentially uncover those responsible for any such violations.”

MMTLP Congressional Investigation Letter from Pete Sessions

FINRA Fraud Evidence

On April 1st, 2023 the Freedom of Information Act (FOIA) was released to the public regarding FINRA’s communication involving MMTLP. FOIA is the United States federal freedom of information law that requires the full or partial disclosure of previously unreleased or uncirculated information and documents controlled by the U.S. government, state, or other public authority upon request. The documents include email transcripts between FINRA and the S.E.C. acknowledging fraud in the ticker (MMTLP) and allowing it to trade for over a year. Investors are accusing FINRA of premeditating the halt since the organization admits to checking MMTLP’s Blue Sheet Data days prior to the halt.

Sam Draddy, the Senior Vice President of FINRA’s National Cause and Financial Crimes Detection Program responds to an email regarding the ticker (MMTLP). He responded on November 29th, 2021, a whole year before FINRA halted MMTLP. This evidence concludes FINRA was well aware of the fraud and counterfeit shares occurring in the security, however FINRA still allowed it to trade for over a year.

The FOIA transcripts include conversations between Sam Draddy and an unidentified S.E.C. representative, the email states; “looks like this MMAT/MMTLP matter has now hit my Fraud team’s radar screen (and seemingly a lot of other radar screens as well). I know you have spoken to Patti Casimates and our General Counsel’s office-but was wondering if it made sense for my Fraud team to have a conversation directly with you and your folks working on the matter so we are not duplicating efforts. We are looking at the two issuers from a fraud/manipulation angle and, in fact, bluesheeting both MMAT and MMTLP as we speak.” This conversation takes place four days before FINRA halted the security. Investors are suspecting when FINRA investigated the blue sheet data for MMTLP the organization realized there were too many counterfeit shares which initiated the halt of the security.

Email Transcripts from FINRA via FOIA request

The price of MMTLP dropped dramatically from $7+ to $2.90 one day before the halt. It’s alleged that FINRA notified Hedge Funds, Market Makers, and Insiders of the U3 halt. The transcripts is evidence that FINRA was aware of the counterfeit shares and fraud, however the organization did not notify investors. Instead FINRA halted the security preventing short sellers from closing and covering their positions. Two days after the halt FINRA’s CEO Robert W. Cook sent emails out to employees to “take the week off as the organization received a large amount of complaints and threats.”

Robert W. Cook email to employees

The 100 Day Halt Affecting 65,000 Investors

It’s officially been over 100 days since FINRA halted trading of MMTLP. This security was Meta Materials Inc preferred shares that were being spun-out into a private company. The company had an approved corporate action and all shareholders on record date of December 12th were set to be transferred into a private company. This security allegedly had hundreds of millions of counterfeit shares and a large number of short sellers. All legal short positions were required by their brokerages to close out their position prior to the record date. FINRA halted trading on December 9th, days prior to the companies record date preventing shorts from closing out their position and the opportunity for shareholders who didn’t want shares of a private company to sell their shares.

Days prior to the halt FINRA had a scheduled meeting with the DTCC, lawyers, and the company’s representatives to discuss the corporate action, however FINRA didn’t attend. According to the companies filings their preferred shares were not supposed to trade, however market makers and hedge funds used fraudulent information and submitted it to S.E.C. and FINRA to have it trade on the OTC markets.

65,000 investors are seeking answers from FINRA, and demanding their trading days back. Daniel Duffy states; “The actions and inactions of FINRA and its members in allowing these liabilities to persist and be substituted with liabilities for different securities in a different company, all while leaving shareholders with counterfeit shares, is unacceptable.”