SWIFT payments network access cut to crypto exchanges

Inflation data for December: 6.5%

Wall Street climbs; Powell comments avoid rate policy

Just what the title says. Jerome Powell was set to speak about the economy and FED’s policies today. Full story here: https://www.reuters.com/markets/us/futures-edge-lower-ahead-powells-speech-2023-01-10/

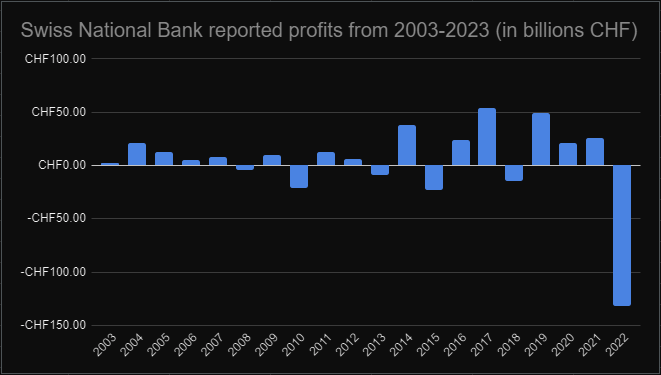

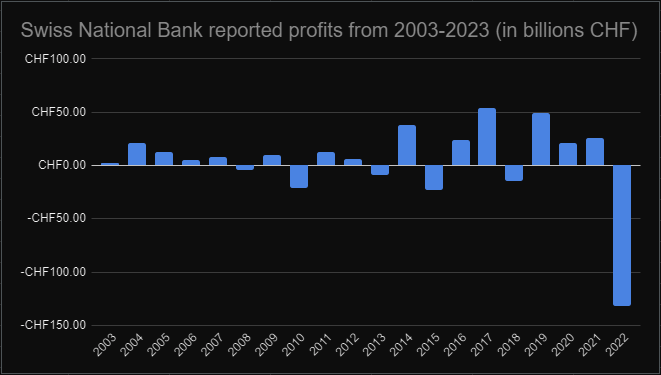

Swiss National Bank reports a loss of 132B francs ($143B), which is a lot

Bed Bath & Beyond Warns It May Go Out of Business

-

Company includes going-concern warning in SEC filing

-

Retailer weighing options, including potential asset sales

- Full story: https://www.bloomberg.com/news/articles/2023-01-05/bed-bath-beyond-issues-going-concern-warning-reviews-options

This is sad for us, retailers. We dont want Amazon devouring the entire physical (and digital) economy. We don’t want Wall St devouring Main St.

What happens is that operating normally is just not profitable. Amazon took all the brick and mortar shops out of business – but Amazon’s physical store itself is not profitable, either. Only their AWS branch (digital services) has been profitable lately. So in this “everything squeeze,” it appears more and more that normal operations are not profitable, for anybody.

And if a business entity finds a way to be profitable, the market adjusts quickly (weeks? months? years?) to reduce margins to near-zero, and profit disappears again. Of course, the question is: what do we do now? And how to operate in such conditions? And that, my friends, will be a topic for a future lengthy article (or several).

Turns out (1) University of California gets to gamble with – presumably students’? – money, and (2) Blackstone casually “guarantees” an 11.25% annualized return on investment for 6 years

The value of the deal is $4B with a B, US dollars. And it has been publicized today, Jan 3rd 2023.

A few questions arise. Firstly, where did the $4B come from? ucod.edu says:

Each of the ten UC campuses has an associated Campus Foundation that is a separately incorporated California non-profit public benefit corporation.

American politicians continue destroying the value of labor

Inversion of 2yr/10yr Treasury yields has been a historically accurate leading indicator of recessions.

Every indication that 2023 will be a miserable year

Actually, just one indication:

SOMA = The Federal Reserve System Open Market Account

For the entirety of 2023 they are projecting negative income, i.e. losses. The losses the FED incurs nowadays, at the end of 2022, are as follows:

Continue reading “Every indication that 2023 will be a miserable year”