From: https://peruvianbull.substack.com/p/edging-armageddon

This past weekend, we were subject to another close shave with Treasury default. Speaker Kevin McCarthy and the Biden Administration were the newest contenders in a fight that is becoming all too common in our current fiscal landscape: the debt ceiling.

The debt ceiling, also known as the statutory debt limit, is a legal cap on the amount of debt the United States government can accumulate to finance its spending obligations. It is set by Congress, and any increase requires their approval. Essentially, the debt ceiling acts as a self-imposed limit to control the government’s borrowing capacity.

The current form of the debt ceiling took shape with the passage of the Second Liberty Bond Act in 1917, during World War I. This act established limits on the total amount of government debt that could be outstanding at any given time. It marked a significant shift in Congress’s approach, establishing a more fixed and permanent debt limit.

Over the years, several pieces of legislation have shaped the debt ceiling’s operation. The Public Debt Acts of 1939 and 1941 introduced the concept of a statutory debt limit, explicitly setting a dollar amount for government borrowing. The Graham-Rudman-Hollings Balanced Budget and Emergency Deficit Control Act of 1985 attempted to link the debt ceiling with deficit reduction targets, imposing automatic spending cuts if those targets were not met.

The primary objective of the debt ceiling is to ensure that the government does not overspend or accumulate an unsustainable amount of debt. It serves as a “mechanism” to encourage fiscal responsibility and maintain the credibility of the United States.

However, this limit has long since lost any and all meaning. Per the Treasury’s own website–

“Since 1960, Congress has acted 78 separate times to permanently raise, temporarily extend, or revise the definition of the debt limit – 49 times under Republican presidents and 29 times under Democratic presidents.”

The ceiling has been raised by both parties, under virtually every President that has held the throne of power for the last 60 years.

Once a tool of financial restraint, it has been morphed into a political hot-potato- a game of political chicken where the parties use the impending doom of default to push through last minute spending and political priorities.

They’re using essentially nuclear brinkmanship to get things done.

The irresponsibility and shortsightedness of this cannot be overstated- as a true Treasury default would be catastrophic for the global financial system. I laid out so much in a Twitter thread on Friday, which I will lay out the basics here for review:

If the government hits the debt ceiling and Congress fails to raise it, the Treasury Department must resort to extraordinary measures to continue meeting its financial obligations. These measures include reallocating funds from various government accounts, suspending the issuance of certain types of debt, and implementing cash management techniques. However, these measures are temporary solutions and can only buy the government a limited amount of time before it runs out of funds.

In the case of the United States, this would mean the government not being able to pay interest or principal on its Treasury bonds, bills, and notes held by investors.

The first and most immediate consequence of a U.S. debt default would be a loss of confidence in American financial stability.

Treasury bonds have long been considered a safe haven investment, and a default would cause ripple effects in the many markets that use Treasuries as collateral- the repo markets, FX, swap, and money markets being just a few examples.

The value of the U.S. dollar would likely plummet as investors lose faith in its stability. This would lead to a decrease in the purchasing power of the currency, making imported goods more expensive and fueling inflation.

The EM crises that hit Thailand, Argentina and others would now come to roost in the States.

This is a serious problem because unlike other countries, the US does not have sufficient foreign exchange reserves as it is the world reserve currency.

Other countries have trillions of dollars in the vaults. We have $38B.

Interest rates would spike as investors demand higher returns to compensate for the increased risk associated with U.S. debt. This would affect borrowing costs for businesses and consumers, making it more expensive to obtain credit for investments, mortgages, and other loans.

This is occurring at record Federal debt levels- further pushing the US into a debt spiral.

Financial markets would experience significant turmoil. Stock markets could plummet as investor confidence wavers, leading to widespread panic selling.

Pension funds, mutual funds, and other investment vehicles heavily exposed to U.S. government debt would suffer substantial losses, similar to how the UK’s pensions blew up as their leveraged UK bond positions were all liquidated-

The U.S. government would face challenges in raising funds to finance its operations. Without access to borrowing through Treasury securities, the government would need to rely solely on tax revenues and other limited sources of income. This could result in significant cuts to government programs and services- and government spending is a component of GDP.

We would see a collapse of GDP of several percent in just a month or two- reminiscent of the COVID shutdowns.

The global economy is intricately interconnected, and a default would disrupt markets worldwide, triggering a global financial crisis similar to the impact of the Lehman Brothers collapse in 2008.

Recall there is over $7T of Treasuries held by foreigners globally- if the US defaults, and it is not remedied immediately, then theoretically these sovereigns could begin dumping their huge Treasury debt positions on the market.

Credit rating agencies would likely downgrade the United States’ sovereign debt rating. This would further increase borrowing costs, making it even harder for the government and businesses to raise capital.

In fact, this is already beginning to happen-

https://www.cnn.com/2023/05/24/business/fitch-places-us-on-rating-watch-negative/index.html

The consequences of a U.S. debt default would also have long-lasting effects on the country’s reputation as a reliable borrower. It could take years, if not decades, to rebuild trust among investors and regain the status of a safe haven for global capital.

————

Default is an unacceptable outcome, and barring an increase in the limit, the Treasury would resort to austerity measures to ensure coupon payments continue to flow out- however with deficit spending still raging, this means severe cuts to many government programs. Social Security, pensions, and veteran’s benefits would be first on the chopping block- but many more would follow in time.

Thus our worst case scenario of a “technical” default would be averted- but at what cost? Recall Treasury would have to issue new bills to pay off maturing ones, a scheme I have described eerily reminiscent of a Ponzi scheme…

And all of this at record high interest rates! The yield on the new bills would be 5.25%, pushing the Treasury deeper into a debt spiral in even the best case scenario. Their auction schedule for the next few weeks can be seen below:

However, we can all breathe a giant sigh of relief. A new debt limit deal was reached Saturday afternoon, and unsurprisingly to those of us who follow this monetary mayhem, it promises to do nothing but make the situation worse. Congress still has to pass this deal, of course.

Here are the key aspects of the deal, provided by the NYT:

- Complete suspension of debt limit for 2 years, until 2025

- New work requirements for certain recipients of food stamps and the Temporary Aid for Needy Families program.

- It would limit all discretionary spending to 1 percent growth in 2025

- accelerate the permitting of some energy projects- such as a new natural gas pipeline from West Virginia to Virginia.

- The debt limit agreement would immediately rescind $1.38 billion from the I.R.S. and ultimately repurpose another $20 billion from the $80 billion it received through the Inflation Reduction Act.

- The proposed military spending budget would increase to $886 billion next year, which is in line with what Mr. Biden requested in his 2024 budget proposal, and rise to $895 billion in 2025.

- A New York Times analysis of the proposal suggests it would reduce federal spending by about $55 billion next year, compared with Congressional Budget Office forecasts, and by another $81 billion in 2025. (Drops in the bucket considering the trillions of dollars of spending the government disburses annually)

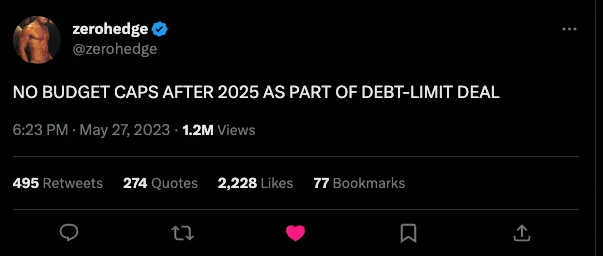

Perhaps most importantly, this section was pointed out by ZeroHedge:

Although Republicans had initially called for 10 years of spending caps, this legislation includes just 2 years of caps and then switches to spending targets that are not bound by law — essentially, just suggestions.

Essentially what this means, as one Twitter user pointed out, is a removal of the budgetary limits on most government spending programs. Historically how government agencies operate, is they are given a budget and allowed to spend an amount, up to a cap, for a fiscal year. If they run close to that limit, the next year they are given the same limit, and usually plus a few extra percent, to achieve their priorities through that next calendar year.

After 2025, there will be no limits- the agencies will spend HOWEVER much they deem they need. They’ll worry about the bill later.

This is the stuff of banana republics…

Can you smell that?

Time to get your printer ready, Jerome.