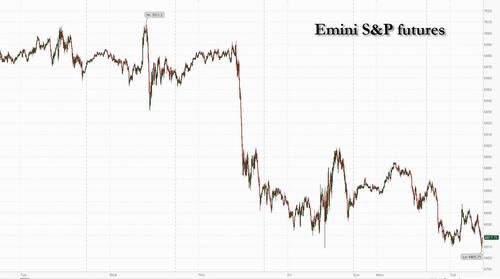

Futures Fall As AI Selloff Resumes

US equity futures woke up after President's Day and chose to resume their selloff (after a modest bounce on Monday's holiday failed to hold) dragged by Tech, as the risk-off moves on AI disruption fears continue. As of 8:15am ET, S&P 500 futures were down 0.5% with Nasdaq 100 contracts falling 1.0%. In premarket trading, all Mag 7 stocks are lower and Semis are being pressured with AVGO / NVDA lower by more than 1%. Pockets of outperformance (and higher absolute returns) can be found in Energy, Fins, Indu, and Defensives. Overseas markets mixed with UK up 70bps, Hong Kong, mainland China, Taiwan, Korea all closed. Lunar New Year Kicks off. Bond yields are low by 1-3bp as the yield curve bull flattens; the USD is bid higher. Commodities are weaker with WTI rising modestly on geopolitics and Ags / Metals for sale. Spot gold dropped toward $4,900 an ounce. Bitcoin, as usual, dumps. This morning we will receive the weekly ADP, Empire State manufacturing survey and NAHB housing market index for February. We will also hear from Fed Governor Barr and San Francisco Fed President Daly; key macro prints come on Friday with PCE and Flash PMIs.

In premarket trading, MAg 7 stocks are all lower (Amazon -0.3%, Apple -0.2%, Microsoft -0.5%, Nvidia -0.9%, Meta -0.6%, Alphabet -1.5%, Tesla -1%)

- AeroVironment (AVAV) gains 3% as JPMorgan initiates coverage with a recommendation of overweight following a selloff in the the drone maker’s stock.

- Fiserv (FISV) rises 4% after the Wall Street Journal reported that activist investor Jana Partners has built a stake in the fintech company, citing people familiar with the matter.

- General Mills (GIS) falls 3% after the packaged foods company cut some forecasts for the full year.

- ImmunityBio shares (IBRX) gains 6% after the drugmaker said the Saudi Food and Drug Authority encouraged the company to submit a regulatory package for its bladder cancer therapy to expand access in Saudi Arabia.

- Masimo (MASI) jumps 34% after the Financial Times said Danaher is closing in on a nearly $10 billion deal to buy medical technology company, citing unidentified people familiar with the matter. Shares of Danaher (DHR) fall 6%.

- Norwegian Cruise (NCLH) rises over 7% after the Wall Street Journal reported that activist investor Elliott Investment Management has built a more than 10% stake in the cruise-ship company.

- TripAdvisor (TRIP) inches less than 1% higher after Starboard Value LP announced plans to nominate a majority slate of director candidates for the 2026 annual meeting.

- Veeva Systems (VEEV) rises over 1% as Morgan Stanley upgrades the the application software company to equal-weight, saying competitive risks are “better understood.”

- Warner Bros Discovery Inc. (WBD) rises over 2% after agreeing to temporarily reopen sale negotiations with rival Hollywood studio Paramount Skydance Corp., setting the stage for a potential second bidding war with Netflix Inc. Shares of Paramount Skydance (PSKY) gain 3%.

- Zim Integrated Shipping (ZIM) surges 35% after Hapag-Lloyd AG said it’s buying the Israeli shipping company.

In other corporate news, WSJ reports that activist Elliott is said to have built a large stake in Norwegian Cruise Line. Apple will hold a product launch on March 4. Anthropic’s talks to extend a contract with the Pentagon are said to have stalled on surveillance concerns. The Pentagon is also said to be seeking voice-controlled, autonomous drone swarming technology, with SpaceX among companies competing.

US traders are returning to their desks eying firms’ swelling AI budgets, while also wary of the technology’s potential to hurt industries outside the tech sector. Meanwhile, Brent crude erased losses as Iran talked up military drills near the Strait of Hormuz — at the same time that the country is undertaking a fresh round of indirect nuclear negotiations with the US.

There’s “lingering anxiety about whether AI spending will be profitable enough, concerns about competition, and a broader de-risking from the most crowded trades after a very strong run,” said Aneeka Gupta, macroeconomic research director at WisdomTree.

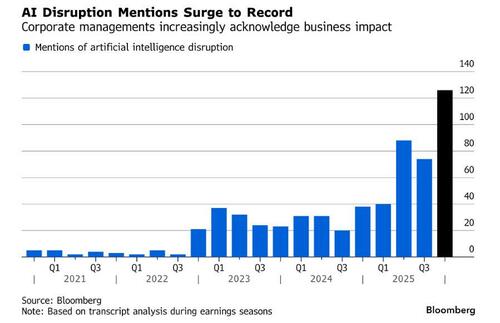

The search for stocks on the right side of the artificial intelligence trade is front and center for investors at the start of a shortened week — with a backdrop that may benefit selective buyers. The “perception of AI seems to have changed completely from the angel of mercy to the kiss of death,” said Stephan Kemper, chief investment strategist at BNP Paribas Wealth Management. Concerns as to whether hyperscalers can monetize ever-growing investments in AI are back while “the fact that AI can often be a tool to enhance profitability is completely ignored,” Kemper added. Two opposing fears are evident - one that AI is poised to disrupt entire industries, the other that investors are skeptical of whether the huge capex outlays will deliver Alibaba unveiled a major update of its flagship AI model, ahead of a much anticipated release from DeepSeek. AI even gets into the Fed’s narrative with Barr due to speak on AI and the labor market, and Daly on AI and the economy later today. returns. And AI is dominating conference calls.

A record number of investors say companies are spending far too much, according to Bank of America Corp.’s latest fund manager survey. A quarter of participants saw an “AI bubble” as the top tail risk to markets, while 30% said capital expenditure on AI by the big tech companies was the most likely source of a credit crisis.

Meanwhile, two-year forward earnings estimates for software stocks have risen over the last three months, undeterred by the selloff over AI disruption worries, according to Goldman analysts, while RBC strategists say equity market is witnessing a type of “sentiment unwind” on AI jitters that likely has more to go.

Over the weekend, Rubio spoke at the Munich Security Conference and emphasized the important of the deep ties between the US and EU, but also echoed the Trump administration’s talking points about the threat of Western decline (WSJ). RTRS reported the Pentagon preparing for the potential for a weeks-long campaign against Iran should Trump decide to launch another round of strikes which comes as the IRGC was conducting "smart drills" near the Strait of Hormuz. Also over the weekend, Trump said Rubio is in talks with Cuba as the island nation faces worsening economic conditions. Trump also said he’s speaking to China’s XI Jinping about weapons sales to Taiwan. Iran’s foreign minister met the UN nuclear chief before the next round of negotiations with the US.

Brent traded 0.1% higher to $68.75 a barrel in London after Iranian state TV in the Islamic Republic reported that parts of the Strait of Hormuz, one of the world’s most important oil-shipping lanes, will be closed for “several hours” on Tuesday as part of Iran’s military exercises. The drills, announced previously, come as Iran and the US start a second round of negotiations in Geneva. Trump has threatened to strike Iran unless it agrees to a deal curbing Tehran’s nuclear program in exchange for sanctions relief. He’s mobilized warships and fighter jets near Iran in response to a recent deadly crackdown by the regime there following mass protests.

Looking at earnings, out of the 371 S&P 500 companies that have reported so far in the earnings season, 76% have managed to beat analyst forecasts, while 20% have missed. Medtronic, Genuine Parts and Vulcan Materials are among companies expected to report results before the market opens. Medtronic’s organic revenue growth for fiscal 3Q is likely to exceed the consensus estimate of 5.5%, driven by strong sales of pulsed field ablation products used to treat atrial fibrillation, reflecting robust demand seen at peers like Boston Scientific and Abbott, Bloomberg Intelligence said. Earnings from Palo Alto Networks and Toll Brothers follow later in the day.

European stocks holding firm with Stoxx 600 up by 0.1%. The utilities sector outperforms as artificial intelligence worries linger and tensions in the Middle East drive a risk-off mood among investors. Miners lag as precious and industrial metals prices drop. On the data front, UK employment data surprised to the downside where the unemployment rate rose to 5.2%, above consensus and the BOE's forecast of 5.1%. Following the print, odds for a BOE cut in March cut rose to ~80% (vs ~70% Friday). Here are some of the biggest movers on Tuesday:

- Avolta shares rise as much as 5.7% to the highest level since 2021 after UBS upgraded the travel retailer to buy, citing an improving business model focus and favorable industry trends.

- Genmab shares climb as much as 2.7% after Jefferies resumed coverage on the stock with a buy rating, highlighting the Danish biotech company’s attractive valuation and “catalyst rich” 2026.

- SSP shares surge as much as 11%, touching the highest level since December. UBS raised its recommendation to buy from neutral as analysts expect the catering firm’s focus on cash flow generation to ease concerns.

- Mol shares drop as much as 4.1%, down for the third day. The company said it is seeking a release of Hungarian strategic oil reserves to keep refineries operating.

- BFF Bank shares fall as much as 12% to a record low after confirming a report that Italian prosecutors opened an investigation into the specialist lender.

- Qiagen shares slide as much as 4.8% following a Financial Times report that Danaher could announce a roughly $10 billion deal to acquire US medical technology firm Masimo.

- Antofagasta shares sink as much as 5.2% in London. The copper miner’s earnings and dividend payout underwhelmed some analysts, while it kept its guidance unchanged.

- Hensoldt shares slip as much as 4.7%. Mediobanca initiated the stock with an underperform rating on valuation concerns. It leads a drop in European defense stocks ahead of new rounds of Russia-Ukraine peace talks and US-Iran nuclear talks in Geneva on Tuesday.

- Truecaller shares plunge as much as 26% to a record low after the Swedish developer of a caller ID and spam-blocking app gave what JPMorgan analysts called “disappointing” commentary on advertising and the firm’s Truecaller for Business segment.

Earlier in the session, stocks fell in Japan, offsetting gains in India and Thailand, on a day when most of the region’s markets were closed for Lunar New Year. The MSCI Asia Pacific Index was steady, while Japan’s Topix slid 0.7%. SoftBank Group and Hitachi were among the biggest drags, while BHP Group gained. Stocks also retreated in New Zealand, while shares edged higher in Australia, Thailand and India. Volumes were thin, with bourses closed in markets including China, Hong Kong and South Korea. Japanese stock investors extended profit-taking after last week’s post-election gains, as concerns about disruption from artificial intelligence linger.

In FX, the pound weaker but off the low. The Bloomberg Dollar Spot Index little changed with DXY $97, yen and the kiwi outperforming. The yen, historically seen as a haven, strengthened 0.2% against the dollar.

In rates, the risk-off mood and last week’s slower inflation print buoyed Treasuries, lowering the yield on the 10-year note two basis points to 4.03% and sharply lower than beginning of the month and basically at one-year lows; gilts outperformed in Europe after weak jobs data firmed up bets on BOE interest-rate cuts in 2026. In the US, treasuries hold small curve-flattening gains as US trading resumes after Monday’s holiday, with yields having reached new lows for this year, at 4.016% for the 10-year. Most sovereign bond markets also have gains, led by Japan’s, following strong demand for an auction of five-year notes. Yields remain lower by 0.5bp to 2.6bp following the market’s biggest weekly gain since August, driven by softer-than-estimated January CPI data released Friday and volatility in risk assets including US stocks. For IG corporate new-issue calendar, underwriters anticipate weekly supply totaling about $24 billion; about $40 billion was priced last week, with roughly half in the form of Alphabet’s jumbo offering. Treasury coupon auctions this week include $16 billion 20-year new issue Wednesday and $9 billion 30-year TIPS new issue Thursday

In commodities, crude moving higher with WTI $64 up 150bps after Iran said military drills will close part of the Strait of Hormuz for several hours; the rest of the commodities complex lower led by front month gas off 3% to $3.15. Gold weaker, down about $69 to $4,922/oz, and silver sinking to about $74/oz.

The US economic data calendar ADP weekly employment change (8:15am), February Empire manufacturing (8:30am) and February NAHB housing market index (10am). Fed speakers scheduled include Governor Barr (12:45pm) and San Francisco Fed President Daly (2:30pm)

Market Snapshot

- S&P 500 mini -0.2%

- Nasdaq 100 mini -0.6%

- Russell 2000 mini -0.2%

- Stoxx Europe 600 +0.2%

- DAX +0.3%, CAC 40 +0.2%

- 10-year Treasury yield -2 basis points at 4.02%

- VIX +0.7 points at 21.85

- Bloomberg Dollar Index little changed at 1183.25

- euro little changed at $1.1844

- WTI crude +0.9% at $63.44/barrel

Top Overnight News

- German investor optimism fell in February, with the ZEW institute's expectations index decreasing to 58.3 from 59.6 in January, in blow to recovery: BBG

- Traders cemented bets on two BOE rate cuts in 2026 after UK unemployment approached the highest level in five years and wage growth cooled: BBG

- Iran and the US met for a second round of nuclear talks in Switzerland as they seek to avoid renewed conflict in the Middle East. Iranian officials have expressed willingness to discuss their nuclear-enrichment activities, but have tied any concessions to the potential easing of American sanctions: BBG

- A growing number of Wall Street pros say now might be the time to get greedy as AI fear runs amok in the US equity market. Investors are selling entire industry groups when a new AI tool threatens to upset an industry, presenting a chance to buy, according to money managers and analysts: BBG

- Spanish PM Sanchez said the Council of Ministers will invoke Article 8 to ask the Public Prosecutor to investigate Meta (META), X and TikTok.

- EU privacy watchdog opens probe into X over sexualised AI images: FT.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed amid the extremely thinned conditions due to the Lunar New Year holiday and in the absence of a lead from the US, where markets were closed for Washington's Birthday/Presidents' Day. ASX 200 was led higher by outperformance in miners as BHP shares surged after the mining giant reported a 28% jump in H1 net, although gains in the broader market were capped by weakness in tech and real estate. Nikkei 225 retreated shortly after the open with SoftBank and heavy industry stocks leading the declines, as the post-election euphoria petered out following the recent underwhelming GDP data.

Top Asian News

- Japanese PM Takaichi to unveil a sweeping budgeting reform, placing strategic investments under a ringfenced multi-year framework to enhance predictability and attract private capital, Nikkei reports citing a draft

- Japan PM Takaichi considers multi-year budget for growth and crisis management, according to Nikkei citing her draft policy speech for Friday.

- Japanese Finance Ministry estimate indicates annual bond issuance could rise 28% three years from now amid increasing debt financing costs, according to Reuters.

- Indian Government Minister said we are discussing age-based social media ban with firms.

European bourses (STOXX 600 +0.2%) initially started on the backfoot but have reversed earlier losses and are now trading mostly in the green. The SMI (+0.7%) leads, while the AEX (+0.2%) lags, weighted on by losses in ASML (-1.3%). FTSE 100 (+0.5%) sits near the top of the pile, aided by softer-than-expected jobs and wages data, increasing the likelihood of BoE rate cuts. European sectors are mostly firmer. Utilities (+1.3%) and Insurance (+1.2%) reside near the top, with insurance names helped by a broker upgrade for AXA (+1.8%, initiated with outperform at RBC) and a sector perform rating for Allianz. Basic Resources (-1.4%) is the clear underperformer, weighed on by metal prices (XAU -1.3%, XAG -2.4%).

Top European News

- The German Chamber of Industry and Commerce raises its 2026 GDP growth forecast from 0.7% to 1.0%.

- Swedish Finance Minister said they are not expecting to join the Euro in the coming years.

- UK government quietly shelved a programme to build a frictionless post-Brexit trade border, after spending GBP 110mln on a contract with Deloitte and IBM for the project, according to FT.

- EU officials held a constructive meeting to strengthen the international role of the euro on Monday, according to EU's Dombrovskis.

FX

- DXY trades flat intraday but at the lower end of a tight 97.072-97.247 range as US participants gear up to return from the long weekend. Focus has been on geopolitics as US-Iran talks look to continue through to the afternoon, whilst US-Ukraine-Russia trilateral talks have now been moved to tomorrow. On the data front for the day ahead, weekly ADP jobs data are due (prev. showed an average of +6.5k/week over the four-week period). Elsewhere, the Empire State Manufacturing Index for February, and the NAHB housing market index for February are scheduled.

- JPY gained as risk sentiment in Japan deteriorated shortly after the open, while there were some recent comments from former BoJ board member Adachi, who sees a likelihood that the BoJ will hike rates by 25bps in April. During European hours, the JPY remains the outperformer as US yields fall, but overall, the pair remains within the ranges of the last four trading sessions, with today's current parameters between 152.70 and 153.75. Note, JPY could also be seeing some haven flows against the backdrop of the US-Iran talks today.

- GBP fell in the aftermath of a dovish jobs report: unemployment unexpectedly rose to 5.2%, just below the BoE’s 5.3% peak forecast (raised in February), while wage growth slowed across both measures, especially including bonuses. GBP/USD have recovered off its worst levels with the pair currently around the middle of a 1.3552-1.3633 intraday range at the time of writing.

- EUR marginally trickled lower, but with price action kept within tight parameters near the 1.1850 level amid light newsflow from the bloc and the recent mixed EU Industrial Production data. Some risk was taken out for the EUR (for today) as the US-Ukraine-Russia trilateral meeting has been pushed back to tomorrow. A modest four-pip immediate dip was seen as German ZEW disappointed, with EUR/USD currently in a 1.1828-1.1852 range.

Central Banks

- RBA Minutes from February meeting stated that members agreed that prevailing uncertainties meant it was not possible to have a high degree of confidence in any particular path for the cash rate. Board concluded inflation would stay stubbornly high if it had not hiked interest rates as it did this month. Members agreed that the data received since the previous meeting had strengthened their concern that without a policy response, inflation would remain persistently above target for too long.

- NBP Member Dabrowski says April would be safer to cut rates than in March, a policy rate of 3.5% in 2026 is achievable.

FX

- USTs move higher this morning by around 7 ticks, currently trading within a 113-03 to 113-14 range. From a yield perspective, the 10yr is now eyeing the 4% mark (currently 4.025%), and trading at lows not seen since late Nov’25. Much of the upside can seemingly be attributed to the muted risk tone, in an environment clouded by geopolitical uncertainty, with US-Iran and US-Ukraine-Russia talks taking place. The former arguably holds added risk, given there is some chance that the US could strike Iran if talks break down – though analysts believe that the most likely outcome is not a full deal today but a decision to keep talks alive. (Full analysis piece can be found on the Newsquawk feed)

- Bunds follow the global fixed income complex higher. In reaction to the UK’s jobs/wages data, Bunds spiked higher from 129.30 to 129.41. Currently trading higher by around 15 ticks and at the upper end of a 129.13 to 129.36 range – the 10yr yield is trading well outside recent ranges, around 2.733%. Further pressure could see the 10yr test 2.70%, which happens to be the trough from the 1st of December 2025. Following the softer-than-expected ZEW series, Bunds rose from 129.37 to 129.41 - the peak for the day. Demand for German debt remains tepid, with the 2yr Schatz demand sub-2x b/c.

- Gilts gapped higher by 38 ticks before climbing another two to a 92.32 peak, in reaction to the latest unemployment and wage data. If the move continues, resistance comes into view at 92.51, 92.56 and 92.95. Upside spurred in a dovish reaction to a report that showed a further deterioration in the labour market, as the unemployment rate ticked up to 5.2% and is just a tenth shy of the BoE's 5.3% peak forecast (a view that was increased in the February MPR). Furthermore, wage data showed a moderation from the prior for both metrics and markedly so for the measure incl. bonuses. Sparking a dovish reaction in BoE pricing, however, the next cut remains priced for April, but March is now up to -21bps (-20.3bps pre-release) while the timing for a second 2026 cut has been brought forward to November from December.

- JGBs firmer, with upside of just over 50 ticks at best, hitting a 132.60 peak. Upside was a function of the negative risk tone in Japan overnight, where conditions were very limited due to numerous APAC closures. Furthermore, participants continue to digest the policy implications of recent weak GDP data. Note, there was fleeting JGB pressure to a broadly in-line 5yr auction.

- Germany sells EUR 4.59bln vs exp. EUR 6bln 2.10% 2028 Schatz: b/c 1.77x (prev. 2.1x), average yield 2.02% (prev. 2.14%), retention 23.5% (prev. 22.8%).

- UK sells GBP 500mln 0.125% 2028 Gilt via Tender: b/c 4.05x (prev. 3.77x), average yield 3.336% (prev. 3.443%), tail 0.7bps (prev. 0.6bps).

- Japan sold JPY 1.9tln 5yr JGBs; b/c 3.10x (prev. 3.08x), average yield 1.640% (prev. 1.639%).

Commodities

- WTI Mar'26 and Brent Apr'26 are trading around the lower range of USD 62.84-63.87/bbl and USD 67.85-68.62/bbl, respectively. Focus for oil traders is on meetings between the US and Iran and the trilateral talks between Russia, US and Ukraine. At the time of writing, the trilateral talks have concluded, with talks set to resume tomorrow. Much of the action this morning has been spurred by Iran-related commentary; some pressure in the complex on reports that Iran approved IAEA visit to nuclear facilities, but soon reversed after hawkish commentary from Iranian Supreme Leader Khamenei, who suggested that the US army needs to be "slapped" so hard it cannot get up. Most recently, reports suggest that Iran announced its readiness to reduce uranium enrichment, and are now at the stage of discussing technical issues. Ultimately, very choppy action given the mixed newsflow.

- Precious metals have stalled following prior day gains, with the yellow metal slipping below the USD 5,000/oz mark and silver falling by 4.5%, though off worst levels seen during the APAC session. Analysts note that liquidity remains thin, particularly across metals. Focus now turns to US ADP employment figures, which could trigger volatility. Weaker jobs data could trigger a weaker USD, spurring the yellow metal and vice versa.

- Copper prices remain subdued, largely amid the mixed global risk tone and the closure of the Chinese market due to the Chinese holiday. 3M LME Copper currently trades in a narrow range of USD 12,695.08-12,849k/t.

Geopolitics: Ukraine

- Russia's Kremlin said the three-way talk with US and Ukraine in Geneva will continue tomorrow with no news expected today.

- Russian Defence Ministry said Russia carried out a massive strike on military targets in Ukraine, IFX reported.

- Russian President Putin advisor Patrushev said Russia is preparing measures to respond to seizures of its trading vessels, IFX reported.

- Ukrainian long-range drones hit the Ilsky Oil Refinery in the Krasnodar Krai region of Russia and the refinery is on fire, according to Visegrad 24.

Geopolitics: Middle East

- Iran is ready to stay for days and weeks in Geneva in order to reach an agreement, Al Jazeera reports citing the Iranian Foreign Ministry spokesman.

- US-Iran nuclear negotiations in Geneva have entered the stage of discussing technical issues, Al Jazeera reports citing Iranian TV.

- Iran announced its readiness to reduce uranium enrichment, Al Hadath reports citing Iran's ambassador in Cairo; adds "The contradiction of the US statements is proof of its lack of seriousness in the negotiations."

- Iran's IRGC are holding military exercises in the Strait of Hormuz and the Sea of Oman at the same time as US-Iran nuclear talks, Iran International reports.

- Iranian Supreme Leader Khamenei says, in relation to the US, "The strongest army in the world may sometimes be slapped so hard that it cannot get up."

- Indirect talks between the US and Iran have begun with a message exchange process, according to reported.

- Senior Iranian Official said Iran's approach to US talks are positive and serious, but holds no preconception about the outcome.

- "Iran approves IAEA visit to nuclear facilities", Al Arabiya reported.

- Russian President's Aide said Russia, Iran and China sent ships to the Strait of Hormuz to participate in the "Security Belt 2026" exercise, Al Jazeera reported (as expected).

- US officials say they expect Iran to come to Geneva talks today with concrete concessions regarding its nuclear program, according to Axios.

- US President Trump said he will be involved in the Iran talks indirectly and that Iran wants to make a deal. Iran are bad negotiators and he hopes they will be more reasonable in talks.

- US delegation led by Special Envoy Witkoff leaves for Geneva for talks with Iran.

- Palestinian media reported Israeli army conducts bombing operations in deployment areas within Beit Lahiyah and the Northern Gaza Strip, according to Al Qahera.

Geopolitics: Others

- US President Trump said Secretary of State Rubio is talking to Cuba right now and that they want to make a deal, adds will see how it all turns out with Cuba and the US talking.

US Event Calendar

- 8:30 am: Feb Empire Manufacturing, est. 6.2, prior 7.7

- 10:00 am: Feb NAHB Housing Market Index, est. 38, prior 37

- 12:45 pm: Fed’s Barr Speaks on AI and the Labor Market

- 2:30 pm: Fed’s Daly Speaks on AI and the Economy

DB's Jim Reid concludes the overnight wrap

Without wanting to put you off reading any further, this may be the most boring EMR of the year so far, as yesterday was unusually calm compared with the pace of events so far in 2026. However there were a couple of new big AI disruption stories in the European session to report of below. But it was quiet due to the combination of the US holiday and the Lunar New Year in China, offering markets a chance to pause, and the subdued volumes suggested many participants took the opportunity to have a lie down... or watch the Curling or Ski Jumping. Chinese markets remain closed until next Tuesday, with Hong Kong set to reopen on Friday and Korea on Thursday. US markets reopen today, and S&P (-0.58%) and Nasdaq (-0.96%) futures are both trading lower after having edged higher for most of yesterday's session. 10yr Treasury yields (-2.5bps) are also creeping lower again, trading at 4.025% this morning. After last week’s sizeable rally in US yields, attention is firmly on the bond market as investors look ahead to Friday’s core PCE and Q4 GDP releases. Today starts the US data week quietly, with the February NY Fed Empire State Survey (+0.5 expected) and the NAHB Housing Market Index (37 expected) due.

The rates rally is spreading across Asia with 10-30yr JGBs -6 to -10bps lower as I type after a slightly better than expected 5 year auction. The Nikkei is down -0.92%, continuing its decline from the previous session helped by disappointing GDP figures for the fourth quarter.

Meanwhile, the S&P/ASX 200 is experiencing a slight increase of +0.26%, primarily supported by gains from the mining giant BHP Group (+4.75%), which reported robust earnings for the first half of the fiscal year. That's one company AI will struggle to disrupt, although as an aside I just asked our AI tool if it could be disrupted and the one way is if AI allows exploration and discovery to get faster and cheaper for challengers! Is nothing safe! However this is probably also a case where the company could also use such analysis.

Regarding central bank developments, the minutes from the Reserve Bank of Australia’s most recent monetary policy meeting indicated that the rate increase was prompted by stronger-than-anticipated data, ongoing widespread inflation, and relaxed financial conditions. Nevertheless, the central bank expressed uncertainty about the future trajectory of inflation and the economy, resulting in a lack of a “high degree of confidence in any particular path for the cash rate.”

With the US out yesterday, European markets were similarly subdued. Equities saw only modest moves, with the STOXX 600 (+0.13%) and FTSE 100 (+0.26%) finishing slightly higher even with a dip into the close. But beneath the surface, AI related concerns continued to simmer. In Germany, Siemens fell sharply (-6.41%) amid growing worries that industrial software could be another area exposed to AI disruption. That decline weighed on the DAX, which closed -0.46%. Likewise, France’s Dassault Systèmes slumped (-10.44%) on similar concerns, although the CAC 40 (+0.06%) still managed a marginal gain. It’s clear that the market hasn’t yet shaken off this theme.

Across Europe, the news flow remained light as EU leaders returned from the Munich Security Conference. Reports from the FT and Bloomberg suggested the UK is considering increasing defence spending to 3% of GDP by 2029—something that was largely expected, given the concessions needed to secure improved access to SAFE (Security Action for Europe) and more favourable EU trade terms. With no formal announcements likely before the Autumn Budget, investors appeared unbothered by any perceived fiscal implications. Gilt yields edged lower, with the 2yr down -0.7bps and the 10yr down -1.6bps. Elsewhere in fixed income, front-end European yields drifted slightly higher as renewed concerns over oil-driven inflation returned. The 2yr bund was up +0.2bps, while moves along the curve were more uneven, leaving the 10yr bund marginally lower at -0.1bps.

Oil prices rose as geopolitical tensions in the Middle East resurfaced, including reports that Iran’s Revolutionary Guard had begun military exercises in the Strait of Hormuz. Brent crude moved higher on the headlines, adding +1.33% yesterday. However it's down around -0.6% this morning. Markets will keep a close eye on developments as US–Iran talks are scheduled to resume today. Despite the renewed tensions, gold prices slipped yesterday, falling -0.74%. It is another -2% lower this morning with silver over -3% down, now trading $7 below its real adjusted price in 1790!

Looking to the day ahead, data releases include the US February Empire Manufacturing Index, the NAHB Housing Market Index, UK December average weekly earnings and unemployment, Germany’s February ZEW survey, the Eurozone ZEW survey, and Canada’s January CPI. Fed speakers include Barr and Daly, while today’s notable earnings releases feature Medtronic and Cadence Design Systems.