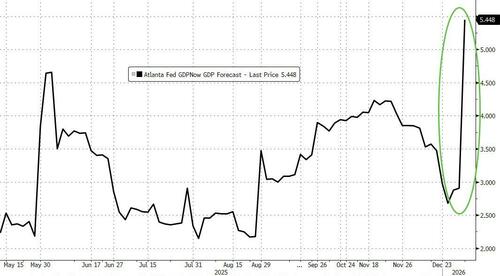

Atlanta Fed Nearly Doubles Q4 Growth Estimate To 5.4% After Strong Data

Authored by Tom Ozimek via The Epoch Times,

U.S. economic growth prospects received a fresh boost this week as the Atlanta Federal Reserve nearly doubled its estimate for fourth-quarter output after a raft of strong data, while Fitch Ratings lifted its projections for full-year 2025 and 2026 growth after delayed government releases showed firmer economic momentum.

The Atlanta Fed’s closely watched GDPNow model lifted its estimate of fourth-quarter real gross domestic product (GDP) growth to 5.4 percent on Jan. 8, up from 2.9 percent a day earlier, after incorporating new data on trade, consumer spending, and services activity.

Separately, Fitch said on Jan. 8 that delayed economic releases revealed firmer momentum in the second half of 2025 than previously assumed, prompting upward revisions to its medium-term growth forecasts.

Geiger Capital described the Atlanta Fed’s upgrade as a “massive expansion” largely attributable to the narrowing trade deficit, with new data released on Jan. 8 by the U.S. Bureau of Economic Analysis (BEA) showing that America’s trade gap shrank to its lowest level in 16 years.

“We’re running it hot. Get on board,” Geiger Capital said in a post on X.

Trade Data

The Atlanta Fed upgrade was driven primarily by a sharp improvement in net exports following October trade data released by the BEA.

The U.S. trade deficit narrowed to $29.4 billion, the smallest monthly gap since 2009, as imports fell sharply while exports climbed to a record high. In the Atlanta Fed’s GDPNow calculations, the contribution of net exports to fourth-quarter growth swung from a 0.3 percentage-point drag to a nearly 2 percentage-point boost, accounting for most of the headline jump.

Consumer spending also strengthened modestly in the “nowcast” model, which showed real personal consumption expenditures growth rising to about 2.1 percent on Thursday from 1.8 percent a day earlier, while inventories, investment, and government spending were little changed.

The Atlanta Fed also cited recent business survey data showing improving momentum late in the year.

A Jan. 7 report from the Institute for Supply Management (ISM) showed U.S. service-sector activity strengthening in December. The ISM Services Purchasing Managers’ Index rose to 54.4, its highest level of 2025, as new orders, business activity, and employment all rebounded.

The service sector, which accounts for roughly two-thirds of U.S. economic output, saw business activity climb to its strongest level since December 2024, while the employment index returned to expansion territory for the first time in seven months.

Eleven industries out of 16 surveyed by ISM reported growth in December 2025, including retail trade, finance, and transportation.

However, price pressures remained elevated despite some easing, with ISM’s prices index staying above 60 for a thirteenth straight month, a level that signals persistent inflationary forces buffeting the service sector.

Fitch Lifts Outlook

In a separate assessment, Fitch said the U.S. economy performed better than previously estimated once delayed government data were incorporated.

Fitch now estimates that the U.S. GDP grew 2.1 percent in 2025, up from 1.8 percent projected in its December outlook, and raised its 2026 growth forecast to 2.0 percent from 1.9 percent.

The agency said third-quarter growth was “considerably stronger than anticipated,” with upside surprises in consumption, government spending, and net trade. While overall private investment was weaker than expected, information technology investment remained robust, rising by 14 percent year-over-year and contributing significantly to output.

Fitch noted that consumer spending has been supported by buoyant equity markets, even as real income growth slowed and households drew down savings. The saving rate fell from 5.1 percent early in 2025 to 4.0 percent by September, suggesting consumers were increasingly dipping into their savings to fund their consumption.

Fitch expects inflation pressures to reemerge in 2026 as delayed tariff pass-through feeds into prices, forecasting consumer inflation of 3.2 percent by the end of 2026. Unemployment is expected to average 4.6 percent, roughly in line with recent readings, as slower job growth is offset by a slowdown in the expansion of the labor force.

The rating agency expects the Federal Reserve to cut interest rates twice in the first half of 2026, taking the upper bound of the federal funds rate to 3.25 percent.

Further, the Congressional Budget Office on Jan. 8 released updated economic projections showing steady but moderating growth, with real GDP expected to rise by 2.2 percent in 2026 before easing to an average of 1.8 percent in 2027 and 2028, amid higher tariffs, slower labor force growth, and cooling inflationary pressures.