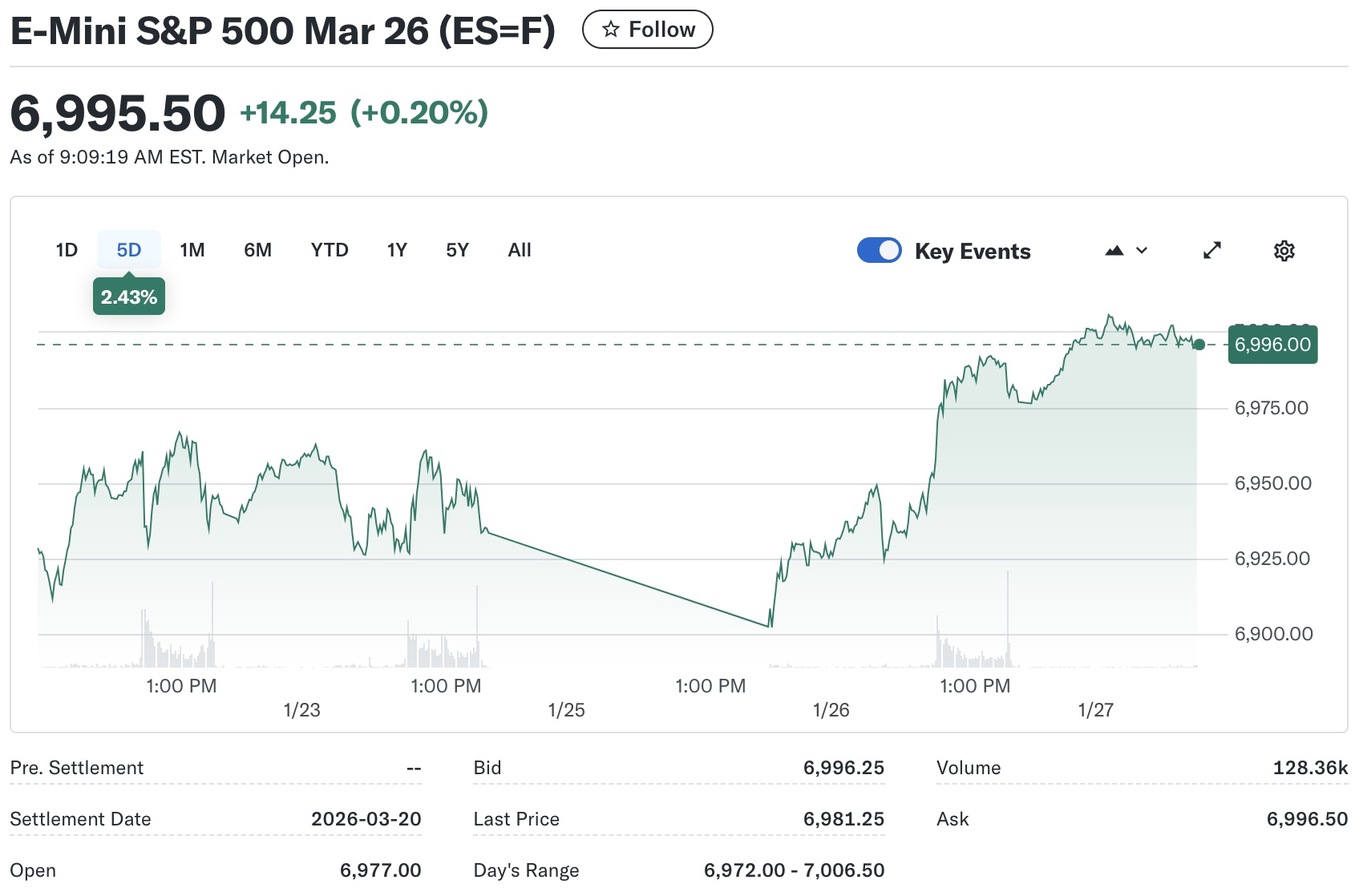

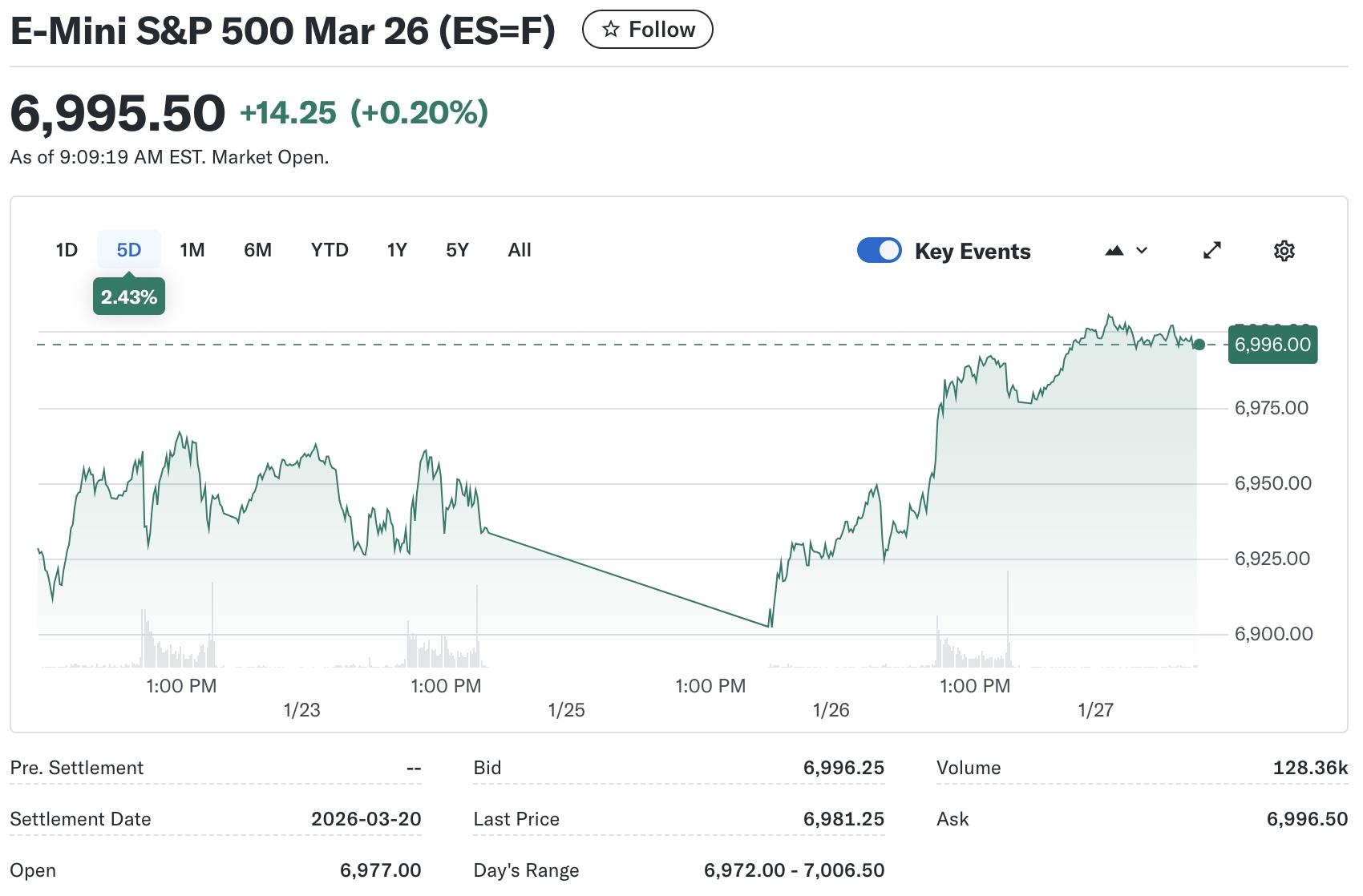

The Markets are Crashing

...or maybe not, according to this picture. Futures were up yesterday, and continue climbing today to all-time highs.

The word “crash” carries a particular kind of weight in financial markets. It evokes memories of sudden collapses, erased wealth, and shaken confidence. Today, that word is once again circulating widely as global markets sell off sharply, volatility spikes, and investors scramble to make sense of what is unfolding.

At the surface, the signs are unmistakable. Major indices are posting steep declines, trading volumes are surging, and once-stable assets are swinging wildly from hour to hour. Sectors that previously led the market higher—technology, growth stocks, speculative assets—are now among the hardest hit. Safe havens, meanwhile, are seeing renewed interest, reflecting a rapid shift in risk appetite.

But market crashes are rarely caused by a single event. They are usually the result of pressure building quietly over time, until a trigger exposes underlying fragility. In this case, several forces have converged. Persistent inflation has forced central banks to maintain tighter monetary policy for longer than many investors expected. Higher interest rates have raised borrowing costs, compressed valuations, and challenged business models that relied on cheap capital. At the same time, geopolitical tensions, slowing global growth, and concerns about corporate earnings have added to the sense of unease.

Psychology plays a powerful role during moments like this. As prices fall, fear feeds on itself. Algorithms accelerate sell-offs, margin calls force liquidation, and headlines amplify panic. Rational long-term analysis is often replaced by short-term survival instincts. This is how corrections turn into crashes—not purely through fundamentals, but through feedback loops of behavior.

Still, it is important to distinguish between market turmoil and economic collapse. A crashing market does not automatically mean the economy is failing, just as rising markets do not guarantee prosperity. Financial markets often overshoot in both directions. What feels catastrophic in the moment may later be seen as a painful but necessary repricing of risk.

For investors, the challenge is resisting emotional decision-making. History shows that crashes, while devastating in the short term, have also been followed by periods of recovery and opportunity. The exact timing and path forward are impossible to predict, but panic-driven exits have often proven more costly than patience.

For policymakers and institutions, credibility and communication matter now more than ever. Clear signals about monetary policy, financial stability, and systemic risks can help prevent fear from turning into dysfunction. Markets can handle bad news; they struggle most with uncertainty.

The markets may indeed be crashing, but crashes are not the end of the story. They are moments of reckoning—forcing reassessments of value, risk, and assumptions that may have gone unchallenged for too long. What comes next will depend not only on economic data and policy decisions, but on whether participants can move beyond fear and respond with clarity, discipline, and perspective.