From: https://nope-its-lily.medium.com/gamestop-power-to-the-market-players-part-2-6ef00eff1d26

So okay, let’s go to the obvious question — if hedge fund tears didn’t cause Gamestop to rocket, what did cause it?

Gamestop in many ways is an extraordinary story, and has all the properties of a successful meme stock (salience):

- Personal name recognition/Nostalgia-For better or worse, we all know/remember Gamestop (primarily from childhood), which is similarly why Hertz performed so well in the afterlife while Mallinckrodt hasn’t.

- A hero and a villain — Much like Tesla, Ryan Cohen represents the hero in the Gamestop narrative, where investors can paint whatever picture of the future they want and justify whatever price tag they pay. Similarly, Melvin and Citron (I mean, even the name Melvin) and the hedge fund industry are (perhaps well-deserved) villains in the arc, helping obfuscate feelings of greed or risk by presenting it as a righteous cause.

- A cataly-ish — For obvious reasons Gamestop is benefiting from the console cycle, but perhaps to a lesser degree than before (its massive real world presence during a pandemic doesn’t help much).

- Humor-What could be more funny than investing in a relic of the early 2000s? Except maybe investing billions into 3d renderings of hydrogen powered cars.

So it isn’t a surprise Gamestop captivated the attention of the internet; despite common belief, the legend of Gamestop extended far outside r/wallstreetbets (although the saga of /u/DeepFuckingValue/RoaringKitty there helped bring substantial energy to the cause).

And how does the internet show some love?

Well, it buys calls.

For better or worse, most new investors have absolutely no concept outside of simple long call/put positions (probably for the best, from experience). In general, most new market positions view long options (and, let’s face it, mostly calls) as a highly leveraged bet on the underlying akin to a lotto ticket, which works beautifully for the following reasons:

- Long options have asymmetric risk-reward, assuming risk-loving participants.

While in prior posts I’ve touched on the expected profit of options being zero, this is only true (it’s never actually true, due to seller’s, variance risk premium, and a host of other factors) under risk-neutral measure. In the real world, investors (especially on indices) tend to be risk-averse (weighting losses more heavily than chance of gain)… at least historically. The new class of retail investors, on the other hand, partly engendered by Robinhood’s extremely gamified UI tends to be risk-loving (“yolos”), favoring chance of gain over (higher) chance of loss.

For that type of an investor, options are akin to a casino due to convexity, or in layman’s terms, “the potential to go up a lot really fast” in value. This is of course true for stocks too (albeit less so, due to the implied leverage of options), but when an individual purchases a stock they have a rather large downside (the entire stock can become worthless). This isn’t the case for a call option, which only represents a portion of the total cost of the stock, but represents the entire upside.

2. Options have to be hedged… often in the underlying.

Before I get 1000 responses telling me this isn’t always true (especially on indices, where you have futures and all sorts of nice things) — it’s more or less true on a meme stock, which basically has no beta or correlation to any other stock (except perhaps other meme stocks). In general, one can anticipate that an option written by a market maker and sold to a retail investor (who owns a long position from that transaction) is hedged in the underlying stock, which obeys the same rules of buying and selling pressure. This is even more apparent in stocks with low float, which tend to move in price substantially with relatively low volume traded. You can imagine how few option contracts it similarly takes (given the implied leverage up to 100 shares worth of delta) to actually move the price (I’ve seen call options move the spot in real time, for instance, on Del Taco stock before earnings).

3. Option buying begets option buying.

What happens when a few individuals buy options on a stock? It moves up slightly (usually in proportion to how many options were bought, what time period they were bought in, and how large the underlying’s float is). This triggers the happy centers in peoples’ brains (yay, we’re making money) and triggers more buying of calls.

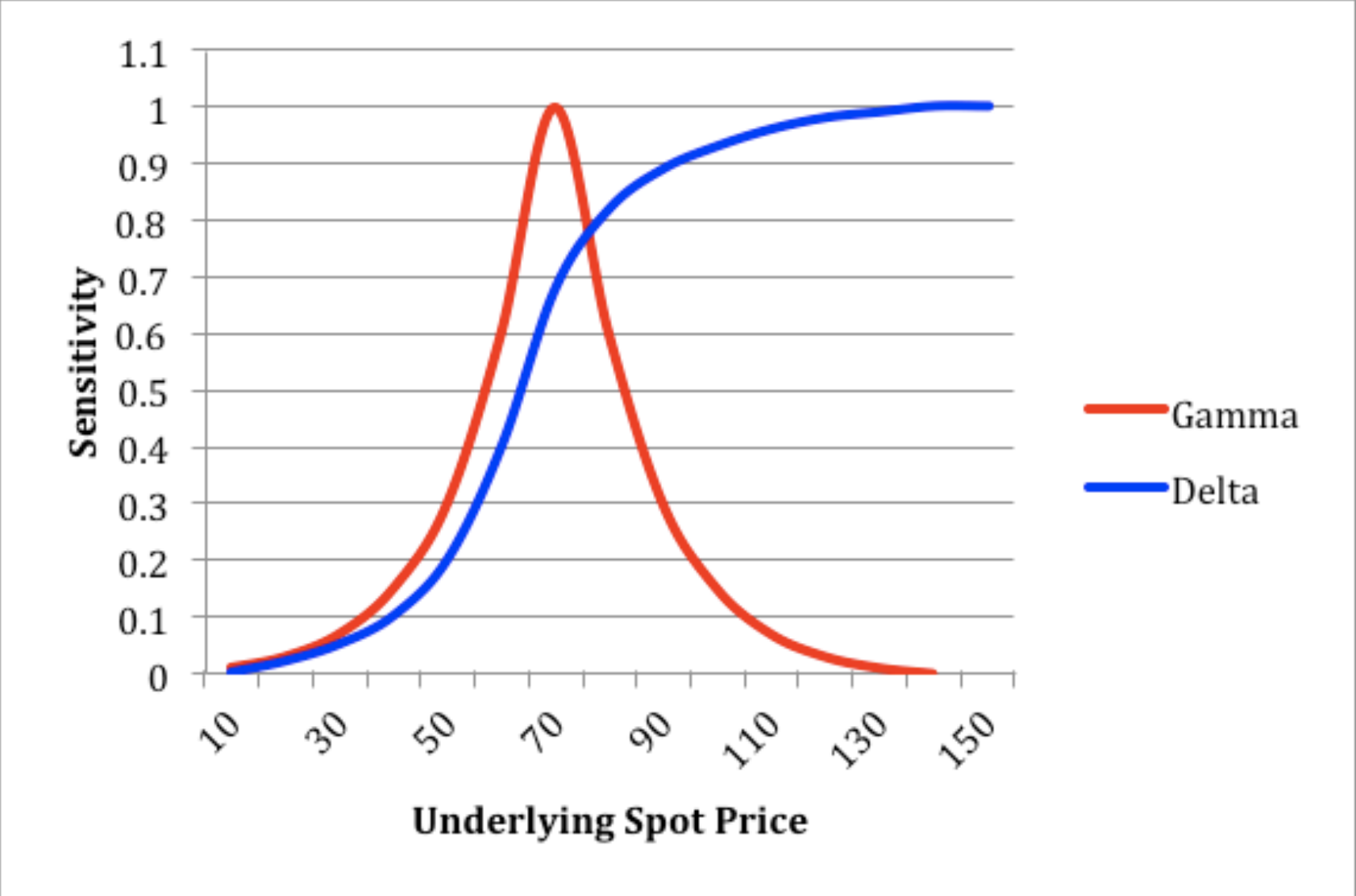

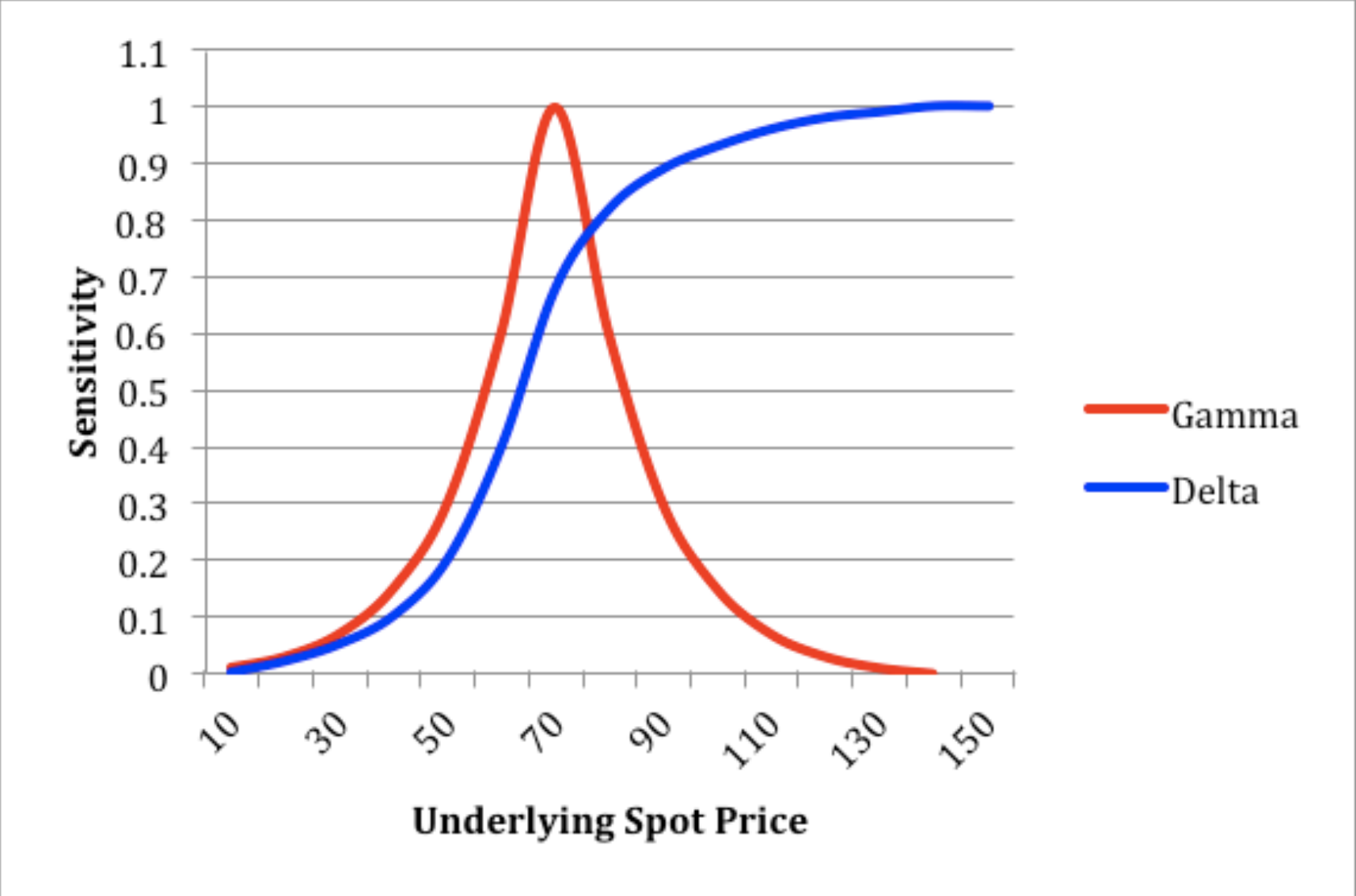

More interestingly, option convexity is largely due to the Greek gamma, which simply refers to the rate delta changes in response to changes in the underlying’s spot price. Delta more formally measures how much we expect the option price to change as the spot price changes, but more usefully for this example can represent how many shares equivalent the option contract controls at the given price. This is why delta represents the hedge ratio — if you, for instance, write a 100 delta (ITM) call option and sell it, you need to equivalently own 100 shares of that stock to neutralize your risk.

Delta is interesting (my favorite Greek) because it is heavily non-linear, and changes in response to:

- Spot price (gamma)

- Time to expiration of the option (charm)

- Volatility of the underlying (vanna)

These are all second order derivatives, so you probably are lost by now if you didn’t take calculus at some point.

So why is gamma important here?

Unlike controlling the equivalent delta’s worth of shares, the value of an option contract increases at a faster rate as it gets closer to in-the-money. This is (one of the reasons) why options have convexity — the value of an OTM call option contract goes up faster as it gets closer to ITM, with a potential for (5,10,100,200+)–baggers (multiples of how much you paid for the initial) if you play it right.

What’s even more interesting though than gamma alone, however, is pairing it with theta, the decay of an option’s value as the time-to-expiration draws closer. This tends to have a strong relationship to the implied volatility — theta represents the time value of the option (extrinsic), and implied volatility is largely the market consensus of the potential for the underlying to move in the time remaining on the option. However, as the days tick down, the time for that move to actually happen diminishes, and therefore the value of the option similarly goes down with it.

As IV increases, theta usually does (especially on short term options), and vice versa. (Helpful video by the tastytrade crew — https://www.tastytrade.com/shows/market-measures/episodes/theta-and-iv-05-17-2019)

So, given my tendency to ramble, the question is — why is this important? Let’s look at gamma and theta in the context of 0-day-to-expiration (0dte) options, and try to piece together what happened to Gamestop on January 22, 2021.

0 Days to Live

0dte options have long been a mainstay of the dopamine addicted day-trader community (including me, sometimes) given they represent the purest form of lottery ticket:

- They expire at the end of the day — You don’t need to go to bed and worry about your position, because it’s either closed or worthless.

- They’re cheap, generally-Theta in particular becomes exponential for 0dte options, and you can quickly buy positions on sale just to gamble as the end of the day grows closer.

- They still represent implied leverage and have that tasty convexity-Like their more respectable brethren, 0dte options still represent the underlying and have all the neat Greeks (gamma, delta, vanna, pajamas, etc.) which make their payouts non-linear and fun.

In general, the optimal strategy to capitalize on 0dte long options is to buy as late as possible in the day, to allow theta to provide as much leverage to you as cheaply as possible.

Let’s Imagine a Scenario Here

Let’s imagine you have a high implied volatility stock that has been stable/slightly declining in price for multiple days. During that time period, theta is aggressively destroying the value of long options, while IV is similarly dropping (both due to theta and due to relative lack of movement). As we get to the final day (this is a weekly, for example), much of the option’s value has now disappeared.

This impacts both put and calls open, though. And let’s say a mean orange decided to start a war on your stock in the days before, causing a flood of short-term puts to hit the market during that week, which had minimal effect (largely due to continual call buying of longer-dated options coupled with actual shares buying pressure due to belief of a short squeeze/Ryan Cohen being the second coming of Christ).

What happens when those puts start to expire? As the days and then hours tick down, the hedges of those put positions (shorted shares) start to unwind, and buying pressure picks up.

Similarly, this buying pressure is noticed by market participants, who start to capitalize on the momentum by buying 0dte call options. These at first have minimal impact, largely because the inflow and outflow of call delta are roughly equivalent (somewhat of a bias towards inflow, pushing price up alongside share buying).

But towards the middle of the day, two interesting things happen:

- Theta and charm become more and more prominent in both making new option positions cheaper and unwinding existing put and call positions.

- Gamma starts to become more dominant due to the high implied leverage versus cost of 0dtes, leading to the virtuous cycle (option buying begets option buying).

These two effects tend to be complementary — as the hedges unwind (given the weekly puts from Citron/the short seller attack) for existing option positions, new 0dte positions can be bought and bought, each time pushing up the underlying as well as increasing the value and delta of other 0dte positions.

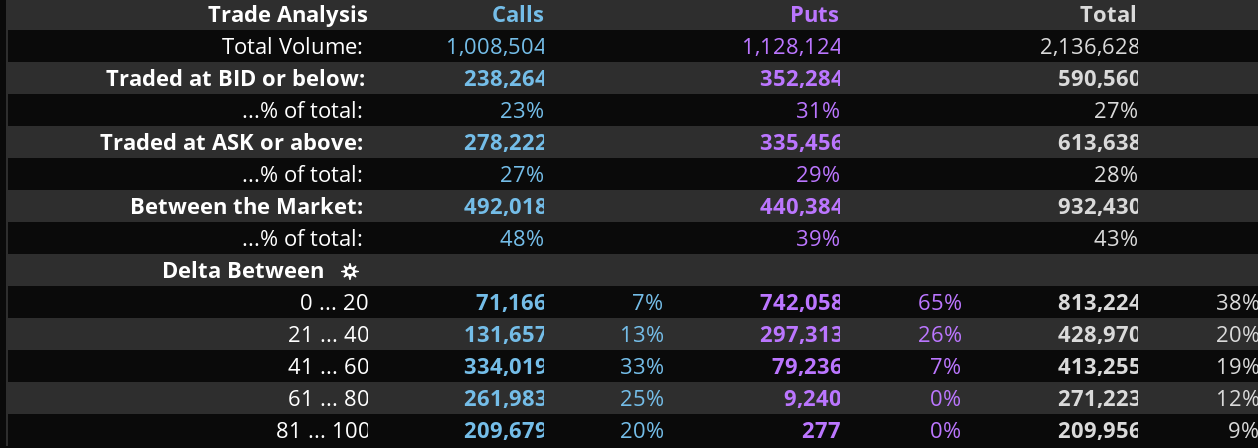

This can be neatly observed in the option volume versus open interest for the 1/22 series on GME:

As the price of the stock goes higher and higher, this continues to attract more and more speculation, hoping to capitalize on the continued momentum. This continues in a loop:

- The price of the underlying continues to increase as put hedges unwind, volatility spikes, and call options are bought (the initial delta hedge).

- The increase in price leads to gamma of existing contracts increasing the delta of those contracts.

- This leads to more shares being bought to hedge those increasingly higher delta positions.

- This leads to more speculation and momentum.

An interesting property of $GME from Friday you can neatly observe is the highest strike in the series is $60, meaning that at Friday’s close, every single call option expiring 1/22 expired ITM. More interestingly is the relationship with gamma, again observable below:

As a contract moves further and further ITM (at one point, GME hit $76 intraday), the gamma of the contract decreases as delta hits 100 on the position. This implies a cap on the momentum from the virtuous cycle described above — while continued call buying can of course drive up the price further, not only does the cost become prohibitive (given that a deep-ITM position is basically equivalent to buying 100 shares in payout), it becomes linear (and therefore boring). Once 100 delta is reached, there is no more cycle of increasing spot price causing increasing share buying, only normal share buying.

And that’s when it drops.

It’s hard to say whether the halt caused the drop (given the mental association halts have to pump and dumps for most investors). In this case the drop assuredly coincided with the halt, but more importantly, we can observe where the drop ended:

In this case, we can observe the drop in price stabilized at $58, before rapidly jumping above $60. This is largely due to gamma and continued 0dte call buying buttressing the fall — as the positions fell farther OTM, shares used to hedge those positions are sold off, further driving the price down (in this scenario, the dealers are almost assuredly short gamma). However, similarly those positions-now closer/OTM and close to expiry-become cheaper at a fairly exponential rate (due to theta and charm).

Speculators again gain conviction, pushing the price up above the highest strike (to the point where gamma provides no real extra push versus the clock ticking down).

This is what we call a gamma squeeze, and isn’t a terribly uncommon phenomenon. It largely follows similar patterns:

- In general, gamma squeezes tend to happen closer to OPEX, due to both hedge unwinding (in the case of a previous put skew, for instance) and due to the 0dte effects mentioned.

- In general, there is both a rapid rise (due to gamma looping and speculators joining) with a similarly steep cliff (especially if the available strikes is exhausted, like what happened to $GME).

Can it be continued forever, though?

In general, the answer unfortunately is yes.

Gamma squeezes in generally power meme stocks, and require a few elements to be true:

- Continued supply of strikes and promise of convexity — Put gamma squeezes rarely happen because well, the maximum value of a put option occurs when the underlying hits 0. Calls, however, have an infinite potential payoff and strikes similarly can be added indefinitely. This allows continued creation of OTM options, which due to cheap premium and asymmetric risk-reward on longs power the gamma squeeze.

- Continued momentum-In general, meme stocks follow the greater fool theory, despite promise of rocket emojis. When they drop, they drop hard.

This is because, as previously mentioned, meme stocks are powered by long calls sold by market makers, who are chronically short gamma. Any selling begets more selling. Even periods of quiescence are dangerous, because without continued inflow of call delta, hedges unwind, and the selling pressure begins.

3. Continued attention-This is where salience shines. The major reason Tesla (the OG gamma squeeze) continued to rocket throughout 2020 was largely due to Elon Musk’s charisma and Tesla’s promise of a better world. It becomes a lot easier to stomach risk for an investor when following a strong personality with a killer story. This role was largely played in Gamestop’s saga by Ryan Cohen, and fed into (potentially unwittingly) by the battle with Citron and the mystique of /u/DeepFuckingValue. It remains, however, to be seen if this will continue.

The moral of the story here is retail, for better or for worse, finally learned how to weaponize options. We’ll see what happens next.