Anon writes:

?? Hello everyone! Y’all know how much I like to talk about this graph:

The very important question is: how come humans became a commodity, and what can we do about it?

Anyway, I just found another very interesting related graph:

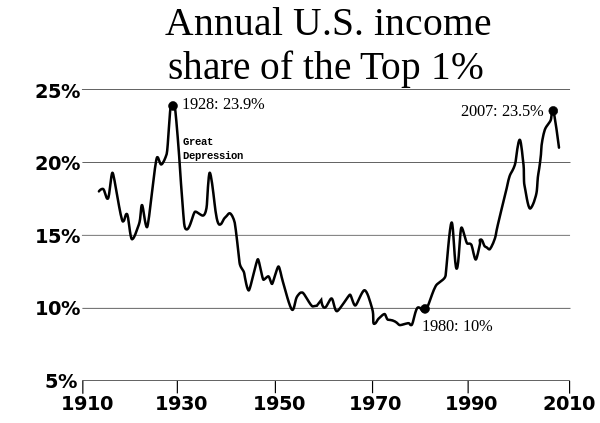

^ that’s a graph of USA inequality. Higher means more inequality. Somehow as if by magic, in 1970’s inequality (in USA) started exploding, and hasn’t stopped. Yeah something happened in 1970’s, some battle was lost by the people.

If anyone has the time to read into it, how come humans are a commodity now, here is a good resource: https://economics.stackexchange.com/questions/15558/productivity-vs-real-earnings-in-the-us-what-happened-ca-1974

Disclaimer: I don’t know the answer. Neither how it happened, nor what to do about it now.

~ * ~ * ~ * ~

Yea, the main operating hypothesis remains that when the gold standard was abandoned in 1971, that’s when the battle of humans vs capital was lost.

( People are scared of AI and a terminator-style Skynet? The battle was already lost in the 70’s, but not against AI, against money itself! )

The solution would be to re-establish the gold standard. This battle is ongoing. The gold nowadays goes under the names of: Bitcoin and Ethereum.

And if you think that the claim that “money destroys humanity” is silly, consider this. The gross product of the world is $100T [1]. Banks hold $200T in derivatives [2], unregulated and unreported. That’s enough to run the world two times over. Total derivative notional value is estimated at $600T nowadays [3] – enough to run the world over, six times. A mortgage is commonly issued for 30 years. And derivatives can be continuously rolled for decades, forever.

References:

* [1] https://en.wikipedia.org/wiki/World_economy

* [2] https://www.usbanklocations.com/bank-rank/derivatives.html

* [3] https://www.visualcapitalist.com/all-of-the-worlds-money-and-markets-in-one-visualization-2022/

I believe that these derivatives hold the stolen wealth of dead 70’s people. Central banks have infinite liquidity, so bankers only had to stash the stolen wealth in a promise, and pay out the promise to themselves (using a swap).

Blockbuster, as an example, is our favorite bankrupt company. They went bankrupt in 2010, that was 13 years ago. So is it over? No, the promise still needs to be held on the books, for operational reasons. And would you look at that – Blockbuster is still being traded, at a quarter-cent per share: https://finance.yahoo.com/quote/BLIAQ And there are thousands of such un-dead companies. (Of course, it’s easier with people and mortgages, because people simply die.) ??