Talking about a January shock again:

Elements of personal-corporate culture

Talking about a January shock again:

Via the agile u/ vadhavaniyafaijan :

The Center for AI and Digital Policy (CAIDP), a tech ethics group, has asked the Federal Trade Commission to investigate OpenAI for violating consumer protection rules. CAIDP claims that OpenAI’s AI text generation tools have been “biased, deceptive, and a risk to public safety.”

CAIDP’s complaint raises concerns about potential threats from OpenAI’s GPT-4 generative text model, which was announced in mid-March. It warns of the potential for GPT-4 to produce malicious code and highly tailored propaganda and the risk that biased training data could result in baked-in stereotypes or unfair race and gender preferences in hiring.

The complaint also mentions significant privacy failures with OpenAI’s product interface, such as a recent bug that exposed OpenAI ChatGPT histories and possibly payment details of ChatGPT plus subscribers.

CAIDP seeks to hold OpenAI accountable for violating Section 5 of the FTC Act, which prohibits unfair and deceptive trade practices. The complaint claims that OpenAI knowingly released GPT-4 to the public for commercial use despite the risks, including potential bias and harmful behavior.

China and Brazil have reached a deal to trade in their own currencies, ditching the US dollar as an intermediary, the Brazilian government said Wednesday.

The deal is expected to reduce costs, promote greater bilateral trade, and facilitate investment.

China is currently Brazil’s largest trading partner. China has similar currency deals with Russia, Pakistan, and several other countries.

Why does it matter? Because no currency lasts forever, and the dollar’s position as WRC (world reserve currency) is being challenged, in current events.

See the book that Peruvian Bull wrote on the topic, for further info: https://piousbox.com/author/peruvian_bull/

(starting with Section 3)Gives the Secretary of Commerce the ability to call anything on the internet(hardware or software) a “Undue risk” of [broad spectrum of poorly defined “Crimes”](essentially whatever the secretary wants) and slap up to 20 years prison and a 1 million dollar fine for anyone using it. I must remind our folks that the secretary of commerce is an unelected position that is picked by the president and set for life unless impeached.

(Section 4) (subsection a) “The Secretary shall identify and refer to the President any covered holding that the Secretary determines, in consultation with the relevant executive department and agency heads, poses an undue or unacceptable risk to the national security of the United States or the security and safety of United States persons….”

(Subsection c.1) ” …with respect to any covered holding referred to the President under subsection (a), if the President determines that the covered holding poses an undue or unacceptable risk to the national security of the United States or the security and safety of United States persons, the President may take such action as the President considers appropriate to compel divestment of, or otherwise mitigate the risk associated with, such covered holding to the full extent the 8 covered holding is subject to the jurisdiction of the United States… “.

Do I even need to spell out why this is Bad? This isn’t even restricted to “foreign investment”, just and “Covered holdings”(see Section 2, subsection 3.B for definiton. it basically means “However the secretary of commerce defines it”).

(Section 8 Sub-section d) Allows Lobbyists and special interest groups to be added to any committees the secretary appoints that determine what websites to ban. Let that sink in. For a hyperbolic example: Apple and Microsoft could hire a shit ton of lobbyists to be added to the committee determining whether Linux should be removed.

(Section 11.a.2.2.F) BANS VPNS. Any action that could be construed as ” action with intent to evade the provisions of this Act”. This is so vague that even that it essentially bans all cybersecurity encryptions including VPNs, Onion Routing, Fucking SSL, and even having a Password because any of those can be spun as trying to avoid investigation under the bill.

(Section 12 sub-section b) Removes any action the secretary and associated committees have taken under this bill from being subject to the Freedom of Information Act. This means the secretary of commerce and his cronies can make any government document immune to FOIA by declaring it part of an “ongoing investigation”.

(Section 15 sub-section d) for those that don’t know ex parte means “used for one party to ask the Court for an order without providing the other party(ies) the usual amount of notice or opportunity to write an opposition.”. This, under the right circumstances, gives the prosecutor the right to submit information on a case without allowing the defendant time to make a defense. It also might imply the right to deny judicial review, but I’m probably wrong there(I hope).

All that and more.

Here’s the bill for public viewing: https://www.congress.gov/bill/118th-congress/senate-bill/686/text

or here for no reason: https://docs.reclaimthenet.org/BILLS-118s686is.pdf

Or if you’re lazy, here’s the leader of the Right to repair movement tearing it a new one: https://www.youtube.com/watch?v=xudlYSLFls8

This thing needs to die. Unfortunately, it’s supported by All Political Parties in Office and is currently Backed by the White House.

Every American ape needs to Call/Text/Email/Snail-Mail/Sext/Telegraph their senators and representative…

Otherwise who do you think the Secretary of Commerce is going to be looking at post MOASS?

Find them here: https://www.congress.gov/members/find-your-member

And text them this way: https://resist.bot/ I.E.>Text RESIST to 50409. Answer the questions the bot texts you, and in about two minutes it’ll send your letter via text to your elected officials, like your members of Congress or state legislators.

u/ Darkhoof shares (for free!) the below. The 2023-03-29 update is pasted at the bottom.

The 10-K report uses very different wording from previous 10-Q and even the previous 10-K report.

This report does not state the precise number of shares directly registered, as mentioned in the previous report. It mentions the number of shares claimed to be held by Cede & Co on behalf of the DTCC: 228.7 million. And that the remainder is held by record holders.

The use of the name of shares held by Cede & Co is the crucial part here. This is a VERY important detail. And I will show you why later. Lets start with the paragraph on the 10-K form:

Our Class A Common Stock is traded on the New York Stock Exchange (“NYSE”) under the symbol “GME”. As of March 22, 2023, there were 197,058 record holders of our Class A Common Stock. Excluding the approximately 228.7 million shares of our Class A Common Stock held by Cede & Co on behalf of the Depository Trust & Clearing Corporation (or approximately 75% of our outstanding shares), approximately 76.0 million shares of our Class A Common Stock were held by record holders as of March 22, 2023 (or approximately 25% of our outstanding shares).

Lets compare this with previous DRS number statements as per the 10-Q forms in Gamestop’s investor relations website:

Q3 2022

As of October 29, 2022 and October 30, 2021 there were 7.3 million and 4.4 million, respectively, of unvested restricted stock and restricted stock units. As of October 29, 2022 and October 30, 2021 there were 311.6 million and 308.0 million, respectively, of shares of Class A common stock that are legally issued and outstanding or are unvested restricted share units that represent a right to one share of Class A Common Stock. As of October 29, 2022, 71.8 million shares of our Class A common stock were directly registered with our transfer agent.

Q2 2022

As of July 30, 2022 and July 31, 2021 there were 5.5 million and 3.6 million, respectively, of unvested restricted stock and restricted stock units. As of July 30, 2022 and July 31, 2021 there were 309.5 million and 306.0 million, respectively, of shares of Class A common stock that are legally issued and outstanding or are unvested restricted share units that represent a right to one share of Class A Common Stock. As of July 30, 2022, 71.3 million shares of our Class A common stock were directly registered with our transfer agent.

Q1 2022

As of April 30, 2022 and May 1, 2021 there were 1.4 million and 2.6 million, respectively, of unvested restricted stock and restricted stock units. As of April 30, 2022 and May 1, 2021 there were 77.3 million and 71.9 million, respectively, of shares of Class A common stock that are legally issued and outstanding or are unvested restricted share units that represent a right to one share of Class A Common Stock. As of April 30, 2022, 12.7 million shares of our Class A common stock were directly registered with our transfer agent.

The wording in the 10-K is very interesting. First, they provide us with a precise number of record holders: 197,058. Then, they provide us with the (claimed) approximate number of shares held by Cede & Co on behalf of the DTCC: 228.7M. Finally, the approximate number of shares held by record holders.

Now who is included in the record holders? This is the definition in previous reports: https://investor.gamestop.com/static-files/5a610aaf-6606-4173-86a1-cba6abdb204a

What is a registered shareholder?

Registered shareholders, also known as “shareholders of record,” are people or entities that hold shares directly in their own name on the company register. The issuer (or more usually its transfer agent, such as Computershare) keeps the records of ownership for the registered shareholders and provides services such as transferring shares, paying dividends, coordinating shareholder communications and more. Shares can be held in both electronic (book entry) through the Direct Registration System (DRS) or certificated form (when permitted by the issuer company).

From previous DD we know this includes not only household investors with directly registered shares, but also insiders that hold them with the transfer agent.

However, one important detail is that mutual funds DO NOT HOLD shares with Cede & Co (as stated by the SEC itself). I repeat mutual fund shares ARE NOT HELD at Cede & Co. https://www.reddit.com/r/Superstonk/comments/xdayfk/i_asked_the_sec_if_etfs_index_funds_mutual_funds/

My Question:

Hi, I’ve been looking all over the place for an answer to this question and can’t seem to find a definitive answer. When ETFs purchase shares, are they registered in their own name at the transfer agent, or does it go through Cede & Co like regular brokers? Also, is it the same for other institutions, such as pension funds, mutual funds, index funds, etc..? Thanks!

SEC Answer:

Dear —-:

Thank you for contacting the U.S. Securities and Exchange Commission (SEC).

You ask whether shares purchased by ETFs, pension funds, mutual funds, and index funds are registered in their own name at the transfer agent or if they go through Cede & Co.

Mutual funds (including index funds) are not DTC-eligible (Depository Trust Company). They are purchased and redeemed (no secondary market) between brokers and mutual fund entities (technically transfer agents, often part of the fund organization, or a third-party processor). The National Securities Clearing Corporation (NSCC) has a platform called Fund/SERV and a related service called Networking that connect brokers placing and settling mutual fund orders with fund transfer agents.

Cede & Co is the nominee name for the DTC but Mutual Funds are not DTC-eligible. What does this mean?

https://www.nasdaq.com/glossary/c/cede

Cede & Co. Nominee name for The Depository Trust Company, a large clearing house that holds shares in its name for banks, brokers and institutions in order to expedite the sale and transfer of stock.

https://www.lexology.com/library/detail.aspx?g=ad927cbb-3afa-4df2-820b-53c7e687b4f2

Companies that regularly engage with securities are likely to interact with the Depository Trust Company (DTC). The DTC is the world’s largest central securities depository. Based in New York City, the the company is responsible for electronic record-keeping of securities balances. It also acts as a clearinghouse for securities trade settlements.

The Basics

Founded in 1973, the DTC’s goal is to improve efficiencies and reduce risks in the securities market. Most banks and broker-dealers are DTC participants. The Depository Trust and Clearing Company (DTCC), a holding company, owns the DTC.

The company manages book entry securities transfers. It also provides custody services for stock certificates. Book-entry refers to uncertificated securities. Users employ an electronic tracking system for purchasing, holding, and transferring book-entry securities. This contrasts with certificated securities, which have physical stock certificates associated with them. Most investors who use a broker hold securities in book-entry form. The two major U.S. stock exchanges, NYSE and NASDAQ, require all listed equity securities to be eligible for a direct registration system (DRS), an electronic book-entry system for recording securities ownership.

Cede & Company is the main custodial nominee that the DTC designates to be the holder of record of the securities it manages that are in its custody. Cede & Co. is a specialized financial institution. Securities will be deposited with or on behalf of DTC and registered in the name of Cede & Co., as the nominee of the company.

From the previous quarter where we know that 71.8 million shares were registered by household investors, we know that 32,875,174 are held by mutual funds according to computershared.net and Insiders hold at least 38,513,981. We can assume that some of the insiders hold them with the transfer agent, we just don’t know who does. WE KNOW, PER THE SEC’s OWN WORDS, THAT MUTUAL FUNDS SHARES AREN’T HELD BY THE DTC UNDER ITS CUSTODIAL NOMINEE CEDE & CO. THEY ARE NOT DTC-ELIGIBLE.

What this means is that from the 308 million shares available at least 110.31 million are not held by Cede & Co. But Cede & Co states they hold 228.7 million shares. The float is at 308 million shares. Where is this discrepancy coming from?

TLDR:

Therefore, my interpretation of the 10-K form can only be one: Gamestop with this 10-k form just stated to all the relevant financial authorities and to the entire world that Cede & Co are misreporting the number of shares they hold on behalf of the DTCC. They DO NOT hold Mutual Funds shares as stated by the SEC itself. If you remove mutual funds and household investor shares from the float only 197.69 (nice) million shares that Cede & Co could reasonably claim as being held by them.

Edit: there’s controversy if mutual funds stock holdings are held at Cede & Co or rather registered at/with the managing fund via the ACATS Fund/SERV system:

https://www.dtcc.com/wealth-management-services/mutual-fund-services/acats-fund-serv

My understanding considering the available information I’ve read and linked in the comments and the SEC’s reply leads me to believe in the later, not the earlier.

We need more DD into ownership structure of mutual fund stock holdings and how can it be abused by our opponents. Hopefully, Dr. Trimbath or Dave Lauer can chime in. Or maybe this is a rabbit hole that might excite some wrinkle brains.

~ * ~ * ~ * ~

2023-03-29 update:

The honorable u/ lawdog7 writes:

A lot of trending posts are unequivocally stating that the DTC, DTCC, and/or Cede & Co. is/are the source(s) of the number of shares that are held in the name of Cede & Co as reported in the 10-k. Let’s first look at the only mention of Cede & Co. within the 10-K:

Our Class A Common Stock is traded on the New York Stock Exchange (“NYSE”) under the symbol “GME”. As of March 22, 2023, there were 197,058 record holders of our Class A Common Stock. Excluding the approximately 228.7 million shares of our Class A Common Stock held by Cede & Co on behalf of the Depository Trust & Clearing Corporation (or approximately 75% of our outstanding shares), approximately 76.0 million shares of our Class A Common Stock were held by record holders as of March 22, 2023 (or approximately 25% of our outstanding shares).

Source. (emphasis added)

So the (multiple choice) question is: who reported Cede & Co as being the holder of 228.7 million shares?

A.) that data is from Cede & Co, DTC, or DTCC

B.) that data is from GameStop

C.) that data is from the SEC

If you read most of the hot posts about this, you’d think the answer is A. But where does it say that? It doesn’t. If that were the case, Gamestop would/should have said something along the lines of “According to the DTCC” or “As reported by Cede & Co,” yet it is completely silent as to the source of that data so the answer is B.

The 10-k is Gamestop’s report. And unless stated otherwise, Gamestop is the source of the information or is adopting the information as true. That is because Gamestop cannot legally mislead investors or include any information that is materially false. Source (“The company writes the 10-K and files it with the SEC. Laws and regulations prohibit companies from making materially false or misleading statements in their 10-Ks. Likewise, companies are prohibited from omitting material information that is needed to make the disclosure not misleading. In addition, as noted above, the Sarbanes-Oxley Act requires a company’s CFO and CEO to certify the accuracy of the 10-K.”)

Accordingly, if the data was from the DTC, DTCC, or Cede & Co AND Gamestop knew it was false, it could not legally report it as it did. It would have to include a qualifier, such as “According to the DTCC, Cede & Co is the holder of 228.7 million shares.” This would be a true statement even if Gamestop knew that such a number was inaccurate because it is only stating what was reported by another entity and not vouching for the veracity of such a statement. (Although, if I’m the lawyer advising on this, I’d say they’d have to go a step further and include a disclaimer that they are not representing that such data is accurate and are including it only as reported by the DTC and without verification).

Because Gamestop reported the numbers without any qualifiers, the only conclusion we can draw is that Gamestop believes that number is correct as it would be in breach of a myriad of laws and regulations if it did not.

So why is the baseless conclusion that “Cede & Co is the source of the data” being pushed? I believe that it is being pushed because it is accompanied by the conclusion that DRS numbers are much higher than actually reported. This conclusion is erroneous for the same reasons as above (i.e. Gamestop cannot report information it knows to be false). And it is a dangerous conclusion for us to make because it decreases the motivation to DRS by encouraging social loafing.

WhY DrS whEN wE aLrEADdy HAvE mOrE tHAn eNoUgH sHaReS rEgIsTeREd?

The truth as we know it and as reported by Gamestop is that we have DRS’d about 25% of the shares outstanding. Becuase no other source is cited, that information is either from Gamestop or adopted by Gamestop as true (e.g. from Computershare and then adopted by Gamestop in the 10k). This is a huge accomplishment, and it should not be downplayed with baseless conclusions. The truth is our best friend and the worst enemy of the hedgies and their Mayo Overlord.

BUY, HODL, SHOP, AND DRS!!

Edit: just want to give my theory as to why GameStop changed the reporting language for DRS’d shares. IMO, there could be a good reason for doing so as it emphasizes something that we all know but most people do not: unless DRS’d, your shares are in the name of some obscure company called Cede & Co.

Anon contributes:

Re: the graph above. A slight correction to yesterday’s chart of gold prices, because I was like, wait, what? Did it really happen that way, that the price of gold was flat until 1971? So I looked up the gold price for 100 years, you can see it at https://www.macrotrends.net/1333/historical-gold-prices-100-year-chart This graph looks accurate, I cross-checked against several sources.

The thickest gray vertical line is the Great Depression of 1929. Gold is a hedge (“insurance”) against the apocalypse itself – when everything is collapsing, gold remains a valuable rare commodity that is also necessary in production of electronics. As the Great Depression unfolded in 1930’s, people used gold to store value, and its price went up. A decade later, as people’s faith in government was slowly restored, they reduced their usage of gold as container of value, by half. In 5 more years, the shock of the Great Depression wore off and gold price returned to its then-balance of $400/oz. This seems reasonable. Gold also has its own economics: the largest gold mine sets the price worldwide.

But yeah, it appepars that the price of gold was indeed flat (excluding that one catastrophic exception) until the 70’s. Importantly, the first graph from yesterday seems to be gold price indexed to the nominal dollar. The graph from today is the gold price indexed to the real dollar (accounting for inflation). Observe the difference.

Generously pasted from: https://archive.ph/n3plH

It was not the banks that created the mortgage crisis. It was, plain and simple, Congress who forced everybody to go and give mortgages to people who were on the cusp. Now, I’m not saying I’m sure that was terrible policy, because a lot of those people who got homes still have them and they wouldn’t have gotten them without that. But they were the ones who pushed Fannie and Freddie to make a bunch of loans that were imprudent, if you will. They were the ones that pushed the banks to loan to everybody. And now we want to go vilify the banks because it’s one target, it’s easy to blame them and Congress certainly isn’t going to blame themselves.”

Wall Street, which was originally designed to finance “creative destruction” (the creation of new industries and products to replace old ones), fell into the habit in the last decade of financing too much “destructive creation” (inventing leveraged financial products with no more societal value than betting on whether Lindy’s sold more cheesecake than strudel). When those products blew up, they almost took the whole economy with them.

Anon writes:

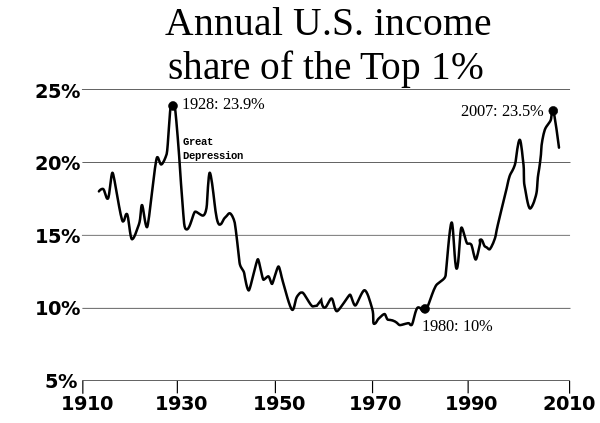

?? Hello everyone! Y’all know how much I like to talk about this graph:

The very important question is: how come humans became a commodity, and what can we do about it?

Anyway, I just found another very interesting related graph:

^ that’s a graph of USA inequality. Higher means more inequality. Somehow as if by magic, in 1970’s inequality (in USA) started exploding, and hasn’t stopped. Yeah something happened in 1970’s, some battle was lost by the people.

If anyone has the time to read into it, how come humans are a commodity now, here is a good resource: https://economics.stackexchange.com/questions/15558/productivity-vs-real-earnings-in-the-us-what-happened-ca-1974

Disclaimer: I don’t know the answer. Neither how it happened, nor what to do about it now.

~ * ~ * ~ * ~

Yea, the main operating hypothesis remains that when the gold standard was abandoned in 1971, that’s when the battle of humans vs capital was lost.

( People are scared of AI and a terminator-style Skynet? The battle was already lost in the 70’s, but not against AI, against money itself! )

The solution would be to re-establish the gold standard. This battle is ongoing. The gold nowadays goes under the names of: Bitcoin and Ethereum.

And if you think that the claim that “money destroys humanity” is silly, consider this. The gross product of the world is $100T [1]. Banks hold $200T in derivatives [2], unregulated and unreported. That’s enough to run the world two times over. Total derivative notional value is estimated at $600T nowadays [3] – enough to run the world over, six times. A mortgage is commonly issued for 30 years. And derivatives can be continuously rolled for decades, forever.

References:

* [1] https://en.wikipedia.org/wiki/World_economy

* [2] https://www.usbanklocations.com/bank-rank/derivatives.html

* [3] https://www.visualcapitalist.com/all-of-the-worlds-money-and-markets-in-one-visualization-2022/

I believe that these derivatives hold the stolen wealth of dead 70’s people. Central banks have infinite liquidity, so bankers only had to stash the stolen wealth in a promise, and pay out the promise to themselves (using a swap).

Blockbuster, as an example, is our favorite bankrupt company. They went bankrupt in 2010, that was 13 years ago. So is it over? No, the promise still needs to be held on the books, for operational reasons. And would you look at that – Blockbuster is still being traded, at a quarter-cent per share: https://finance.yahoo.com/quote/BLIAQ And there are thousands of such un-dead companies. (Of course, it’s easier with people and mortgages, because people simply die.) ??