The Sun Never Sets On Citadel — Part 1

RIP /u/leavemeanon – WHERE ARE THE SHARES (Part 3) Resurrected

RIP /u/leavemeanon – WHERE ARE THE SHARES (Part 2) Resurrected

RIP /u/leavemeanon – WHERE ARE THE SHARES (Part 1) Resurrected

SEC Issues Risk Alert On Options Trading Used To Evade Short-Sale Requirements

_

Actually, an update on the above ^ . It’s not that SEC isn’t looking into it, it’s that the legacy architecture of the markets seems to be stuck, and there isn’t a good current solution and the markets would need to be restructured in a major way, which would take a lot of effort and a lot of time. Citadel going bankrupt right now would be the same as “getting AIDS and spinal cancer at the same time”. The DD pointing it out is The Sun Never Sets on Citadel Part 2.

Feb 24-26: failed launch attempt and proof the DTCC must be the catalyst?

Continue reading “Feb 24-26: failed launch attempt and proof the DTCC must be the catalyst?”

_

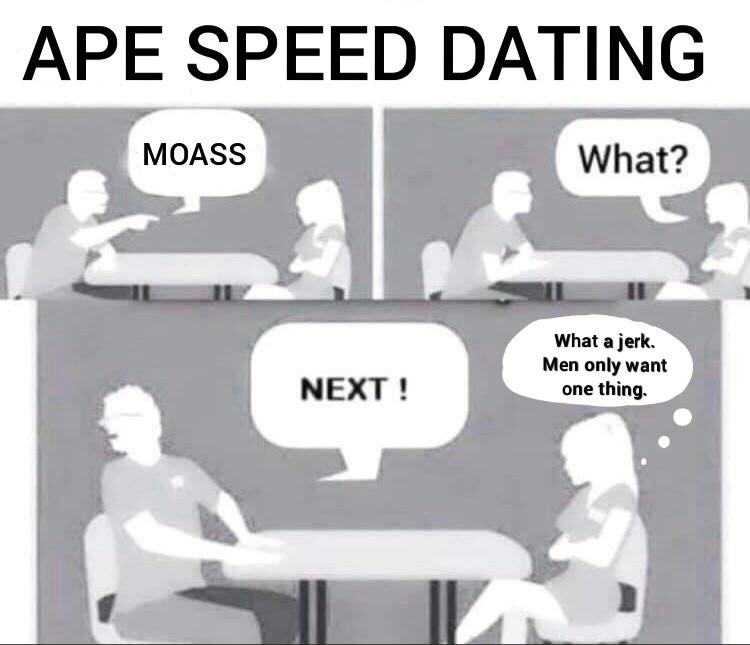

The NYSE threshold list: collapsing shorts and launching the MOASS

TL;DR: restrictions associated with extended periods of failures to deliver inform the past six months of GME shenanigans. These restrictions killed the small players who were short GME in January and allowed big players to take on their position. Big players assumed they could use their powers and resources to turn this losing hand into a big win. Apes stopped them. Now, finally, the big players are going to find these same restrictions applied to them – watch for GME being added to the threshold list.

Continue reading “The NYSE threshold list: collapsing shorts and launching the MOASS”