Ubisoft crashes most on record, faces bankruptcy

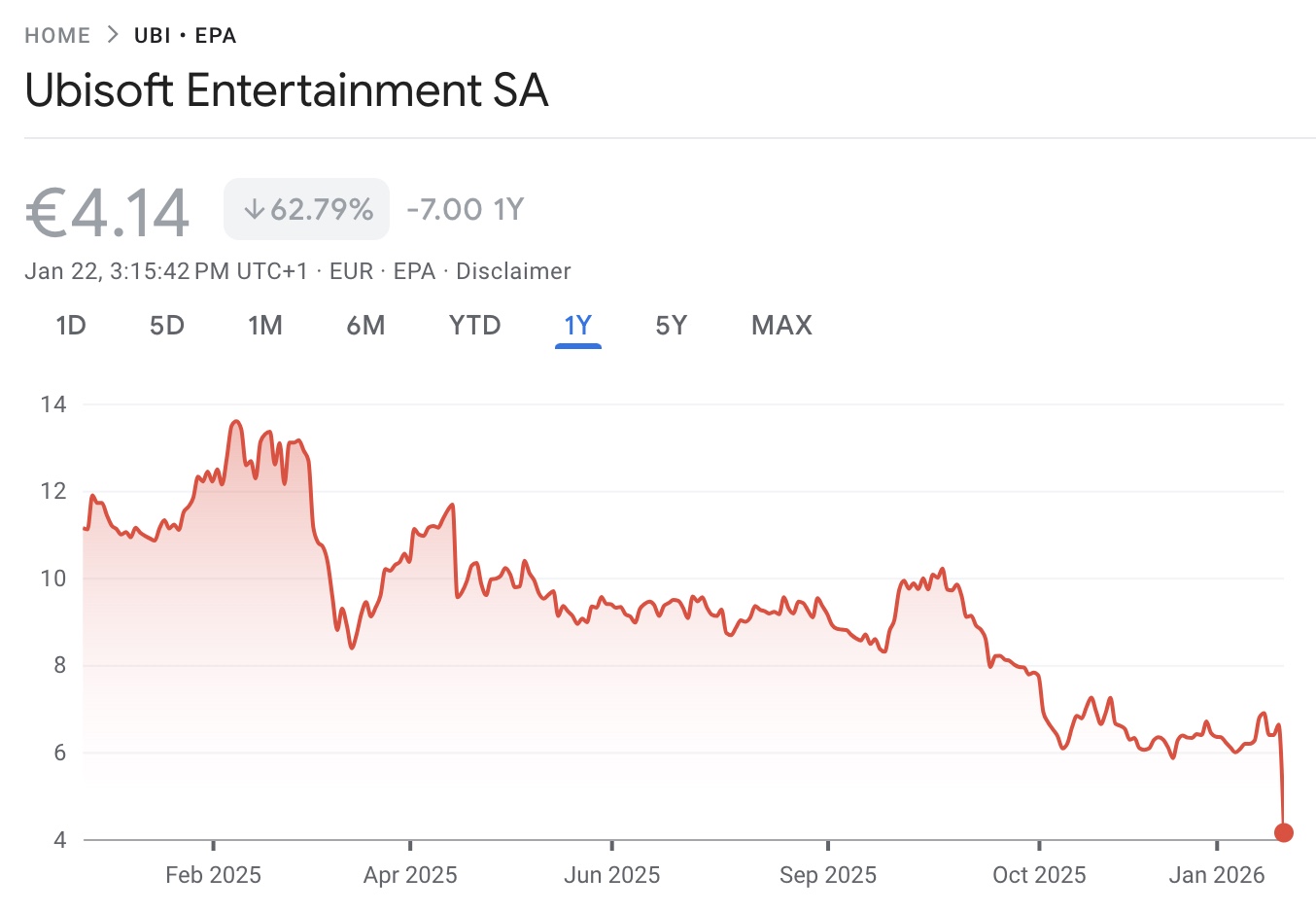

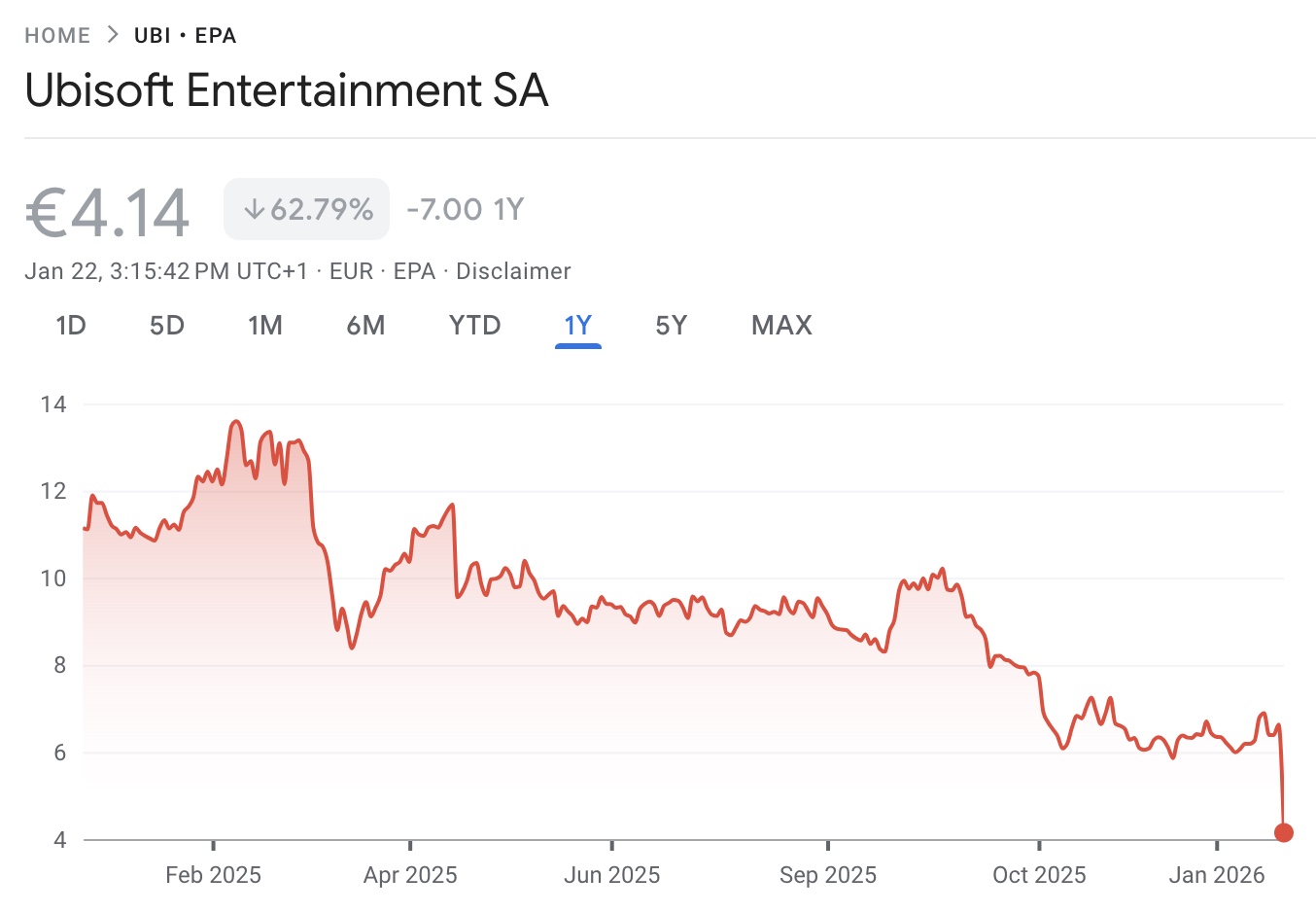

Paris, January 22, 2026 — Ubisoft Entertainment SA, once among the most celebrated names in video game publishing, saw its stock crash more sharply than ever recorded after unveiling a major corporate restructuring and a slate of canceled projects — a shock moment that has raised serious concerns about its future financial stability.

Shares in the French gaming giant plunged as much as 36% in intraday trading, marking the steepest one-day drop since Ubisoft’s 1996 initial public offering. Even after a partial recovery in later trade, the share price remained down sharply, fueling investor anxiety about whether the company’s challenges can be reversed.

Historic Stock Plunge

The plunge came after Ubisoft announced a sweeping reorganization of its development operations and the cancelation of six games, including the long-awaited Prince of Persia: The Sands of Time remake — a project that had already consumed years of development effort. Alongside the cancellations, the company said seven additional titles would be delayed as part of a cost-cutting and portfolio-prioritization effort.

Analysts noted that the scale of the drop not only reflects market disappointment with recent performance but also a broader erosion of confidence in Ubisoft’s ability to consistently deliver successful games.

A Billions-Euro Loss Forecast

As part of its restructuring, Ubisoft revealed that it now expects to report an operating loss of around €1 billion (approximately $1.2 billion) in its fiscal year ending March 2026. This includes a €650 million one-time write-down tied to the cancellations and delays, dramatically altering the company’s near-term financial outlook.

The company also revised its net bookings forecast downward to roughly €1.5 billion, down from earlier estimates, and withdrew guidance for the 2026-27 fiscal year entirely — an unusual step that signals the depth of uncertainty around its recovery path.

Restructuring and Creative Houses

Ubisoft’s response to these pressures is to overhaul its internal structure. Beginning in April 2026, the company plans to split into five “Creative Houses”, each focused on a specific genre and responsible for its own financial performance, from development through marketing. The aim is to foster agility and better align creative output with commercial success.

Management has described this as a “major reset” intended to strengthen operations for sustainable growth, although analysts remain cautious about how effectively it will address deep-seated challenges.

Bankruptcy Rumors vs. Reality

While some social media speculation has hinted at imminent bankruptcy — partly fueled by the company’s tumbling valuation — Ubisoft has not filed for bankruptcy. It remains operational, with cash reserves and ongoing projects, including stable franchises like Assassin’s Creed, Far Cry, and Rainbow Six. However, its market capitalization has fallen drastically from peak levels, and its financial metrics, including negative free cash flow forecasts and a significant operating loss, underscore how fragile Ubisoft’s position has become.

Broader Industry Context

Ubisoft’s troubles mirror broader pressures on large AAA game publishers worldwide, where soaring development costs, shifting player preferences, and a saturated release calendar have made commercial success harder to achieve. Even once-bankable franchises have struggled to reach audience expectations in this environment.

For Ubisoft, the key tests ahead will be whether its restructuring can stabilize development pipelines, re-energize its franchises, and rebuild investor confidence without sacrificing creative identity.

The record stock crash and deep reorganization underline that Ubisoft is in the midst of a make-or-break moment. The company is far from bankruptcy, but unless its new strategy yields stronger results — both creatively and financially — its status as a leading publisher in the gaming industry could be at stake.