Vote Up Down

Markets & Trading

Vote Up Down

Vote Up Down

Vote Up Down

Vote Up Down

Vote Up Down

Vote Up Down

Vote Up Down

Vote Up Down

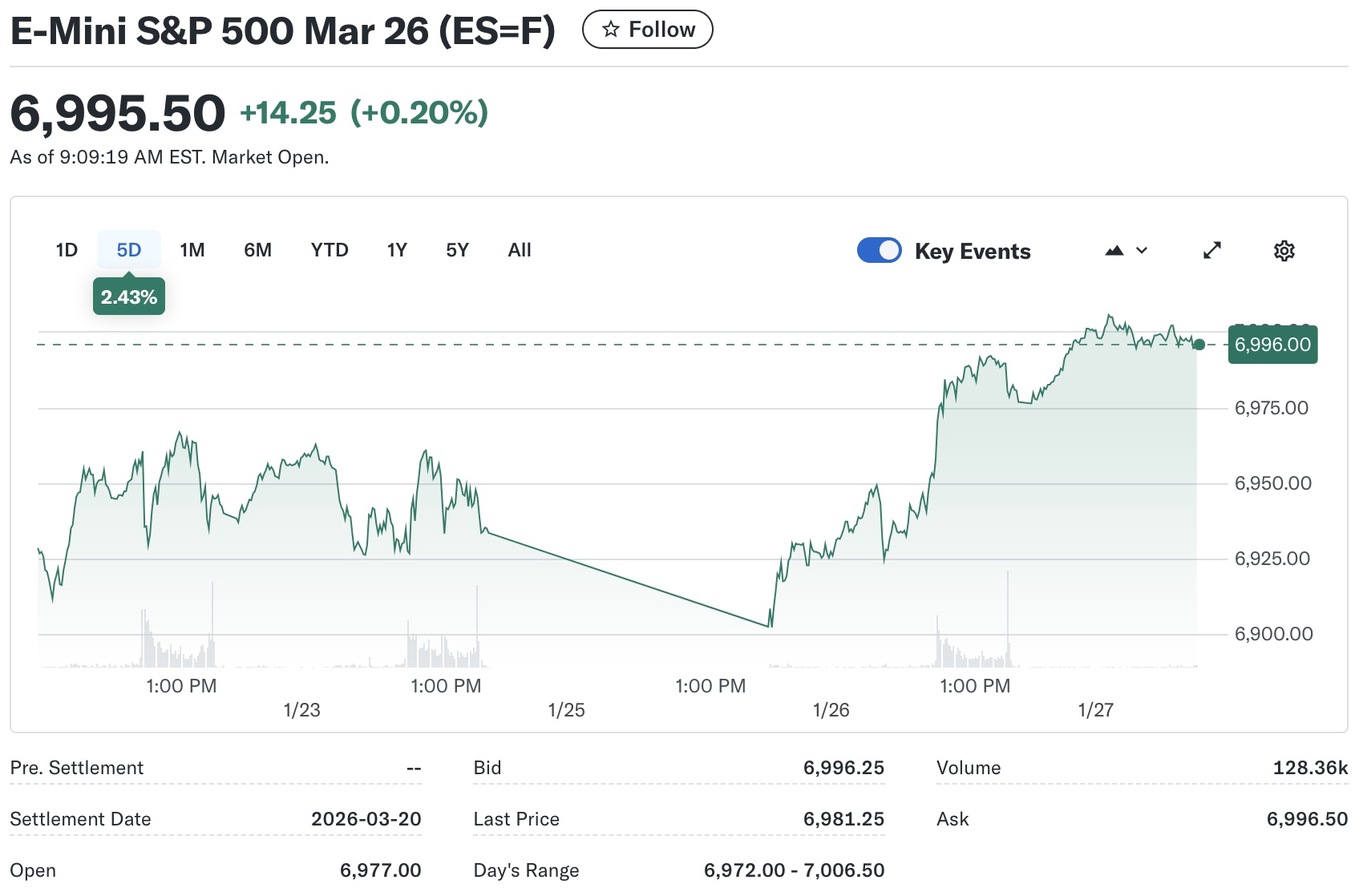

The Markets are Crashing

...or maybe not, according to this picture. Futures were up yesterday, and continue climbing today to all-time highs.

Vote Up Down

Vote Up Down

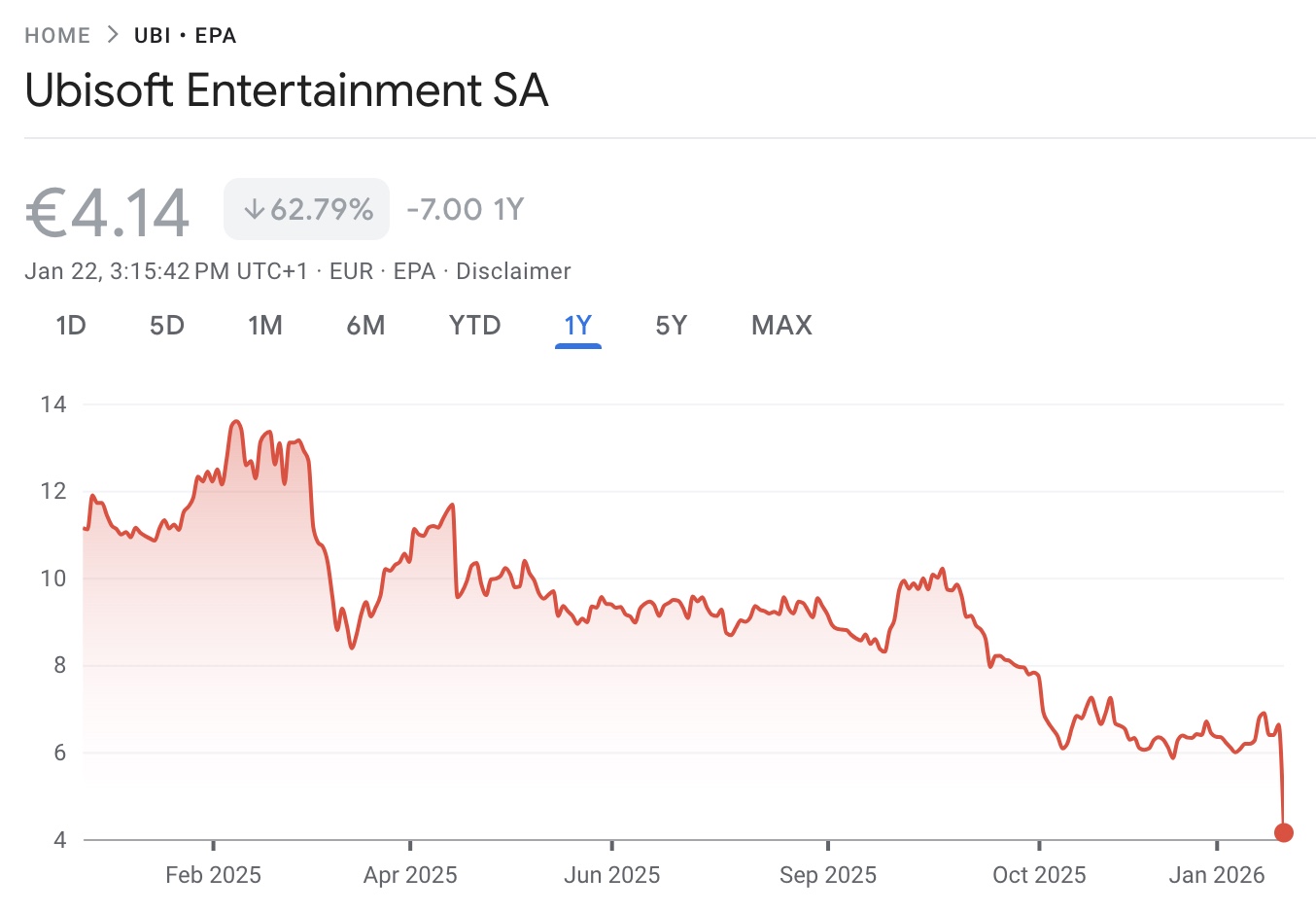

Ubisoft crashes most on record, faces bankruptcy

Paris, January 22, 2026 — Ubisoft Entertainment SA, once among the most celebrated names in video game publishing, saw its stock crash more sharply than ever recorded after unveiling a major corporate restructuring and a slate of canceled projects — a shock moment that has raised serious concerns about its future financial stability.

Vote Up Down

Tesla Cuts Berlin Gigafactory Workforce By 1,700 Employees

Tesla’s workforce at its Gigafactory near Berlin has fallen by about 1,700 employees, according to a report by Germany’s Handelsblatt.

Vote Up Down

Vote Up Down

The Great Tax Deception: Exposing illegal extortion by the IRS

From naturalnews.

Vote Up Down

Vote Up Down