'No One Is Buying The Dip': Traders React As Tech Wreck Continues

'It was the best of times, it was the worst of times' is how one big bank trader described yesterday's price action as Dickens' Tale Of Two Cities intro perfectly described the to-ing and fro-ing with the US Tech sector as the once one-way trade in anything TMT has dispersed aggressively with winners and losers being 'picked' as Anthropic reminded investors that AI disruption risk is no longer theoretical.

“This year is the defining year whether companies are AI winners or victims, and the key skill will be in avoiding the losers,” said Stephen Yiu, CIO of Blue Whale Growth Fund.

“Until the dust settles, it’s a dangerous path to be standing in the way of AI.”

And the selling pressure is not abating...

The selloff in software stocks spread to Asia on Wednesday...

Asian software stocks also slid, with shares of Indian information technology companies the latest to buckle.

Bellwether Tata Consultancy Services Ltd. sank as much as 6%, while Infosys Ltd. dropped 7.1%. Cloud-based accounting software maker Xero Ltd. fell as much as 16% in Sydney trading, the most since 2013.

...and is yet to come to a halt in Europe.

A UBS basket of European companies seen at risk of AI disruption fell another 2.1%, a day after plunging 8%. SAP SE and Sage Group Plc are among stocks extending losses.

Interestingly, to hedge against the disruptive nature of AI, investors have instead flocked to companies that have factories and infrastructure. Chemicals, telecommunications and automobiles were the best-performing sectors within Europe’s benchmark Stoxx 600 on Wednesday.

But, as we detailed here, here, here , and here yesterday, the pain was not just in tech, as Alts and BDCs suffered significant losses as the strain of lower marks on loans to losing software firms weighed on these private credit providers (which was exacerbated by the fact that a group of banks led by Deutsche Bank has been unable to sell about $1.2 billion of loans backing the acquisition of a software provider).

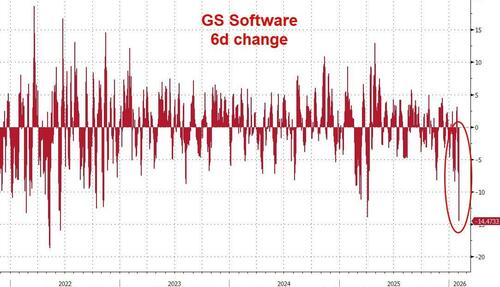

Software trading at its lowest since Liberation Day...with its biggest down-day since then too...

The pain is extending this morning with Nasdaq futures down...

“There’s clearly indiscriminate selling across the entire software cluster,” said Karen Kharmandarian, senior equity investment manager at Mirova in Paris.

“There’s no floor, the downward momentum is too strong. It looks a bit like capitulation.”

As Goldman's Nelson Armbrust confirmed, jitters forming over the past few days have quietly built a tinderbox that suddenly exploded to the downside, with AI and Software concerns significantly broadening out across names & sectors that previously had been immune to the narrative.

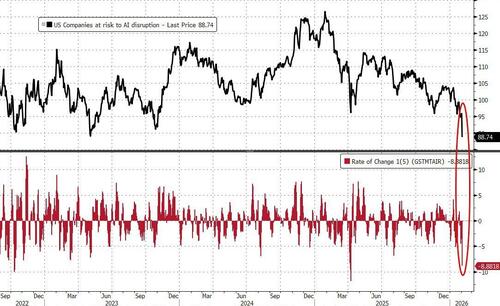

Also, Goldman's Louis Miller highlighted that AI At Risk had its worst day in nearly 5 years and third worst day on record.

Software was hurting across the board and our Broad Software Basket has now lost $2tn of value from the highs, ~30% drop in market cap. Even though software is now in a bear market and has entered oversold territory, no one is stepping in to defend the complex yet and buyers continue to beware.

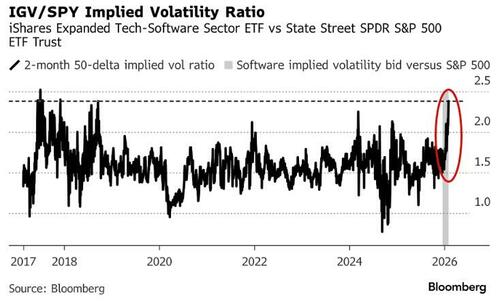

In options-land, the implied volatility of software stocks is blowing out versus the S&P 500 ETF...

So what happened?

Handful of things people are pointing to:

1) Anthropic launched a AI Legal Tech tool,

2) IT earnings (IT earnings in the past had catalyzed some concerns on AI),

3) our EU desk pointed to PUB numbers missing, and

4) the two names US investors try to ‘fight the AI narrative’ in, Adyen and LSEG, were both notably underperforming overnight – which we think had rattled many in the info services space prior to market open.

Vol, vVol, Gamma and Skew all moving higher on some Downside hedging (and frankly, ongoing healthy demand for Tails in both S&P and VIX), as the AI trade perversely “eats it own” inside Tech, with the Software “existential crisis” really picking-up velocity, knocking-into Credit space-concerns and causing some serious “Dispersion / Rotation” within Equities Leadership, out of “Expensive” legacy Growth and into “Cheap” Value

Nomura's Charlie McElligott points out that there is a fair bit of the US Equities “From Tailwind to Headwind” potential of the AI story going from ’25 into ’26 is the now well-socialized implications of:

1) the “Cashflow for Capex Burn” and even more expansive funding needs for the AI Hyperscalers this year, with major implications for Credit issuance as a rare “Spread widener” impulse just on $magnitude alone...

...along with 2) said “Cash Burn” then too having tangible negative implications as a “flow” change of Corporate Stock BUYBACKS as well.

The Macro “Real Assets over Fiat” -story has obviously been a 30k foot theme in recent months, with regard to “Fiscal Dominance” and big deficits being run global, piling onto the “dis-ease” of US policy volatility overall feeding the white-hot performance of Metals (Precious primarily, but a little bit of Base as well) relative to the “Fiat Debasement” and De-Dollarization” -narratives trending in the market over recent months….

But it’s actually quite interesting now where too on the Equities / Corporate level, there’s a derivative -theme of said “Real over Digital” playing-out in violent fashion: If the nature of the business you’re in is selling Digital goods and services as the “profit model” (SaaS and BITCOIN even, lol) vs selling “Real Things,” you’re getting cooked on the Anthropic / “AI Disruption” implication fears hitting meaningfully ahead of schedule, i.e. Anthropic / Clawdbot almost single-handedly launching the Software sector into oblivion in recent weeks...

No one is interested in buying the dip...

...according to JPMorgan analyst Toby Ogg, and even good earnings won’t be enough, since AI disruption is a long-term issue.

“We are now in an environment where the sector isn’t just guilty until proven innocent but is now being sentenced before trial,” he said.

Bloomberg reports that Ogg met more than 50 investors across Europe and the US over two weeks and said he found that they had significantly reduced software holdings over the past 12 to 18 months.

Even after the latest pullback, “the general appetite to step in remains generally low,” he said in a client note.

For software companies, “better-than-expected results are no longer enough to convince the market,” Ogg wrote.

That’s unless “they can demonstrate irrefutably that AI is a sustainable tailwind to growth rather than a longer-term headwind,” he said.

What’s more, if software companies use their own AI tools to adapt products, their previous revenue models would face transition risks. Eventually, any new launches from leading AI platforms, such as the latest legal offering by Anthropic, will exacerbate investor concerns around the sector, Ogg said.

Morgan Stanley's Quant Desk offers some insights into today's action: Lots of questions on how such a seemingly rotational market is ending up in broadly lower equities today.

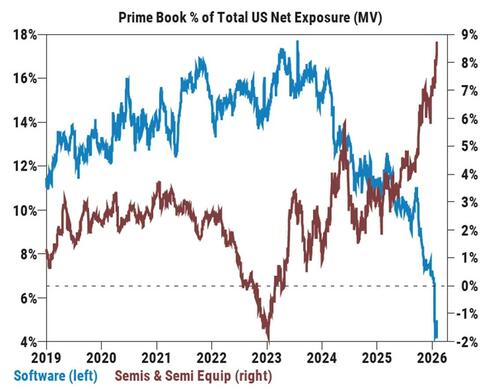

While there are big gaps between winners and losers (dispersion is in 99th %ile), part of the issue is that the other natural side of Software – i.e. Semis – is already very, very full per MS PB content – and so is failing to rally (MSXXSEMI at -4% is underperforming it’s beta by almost 1%).

In addition, HFs are coming off one of the biggest days of long adds over the last year per MS PB Content, and investors have been quick to reverse recent flows this year when there is volatility. The retail bid also slowed some since noon (although showing some signs of life in the last few minutes) which is weighing on broader markets.

With equities lower, supply from systematic macro strategies (CTAs, vol control, risk parity) has the potential to grow given elevated equity leverage sitting in the 90th %ile vs the last 5 years. If SPX ends the day at -1%, equity supply in the next week is modest at -$8bn (-0.3 z-score magnitude), but at -1.5%, that grows to $20bn (-0.8 z-score magnitude), and at -2% that grows to $35bn in the next week (-1.1 z-score magnitude), some today but mostly spread over the next few days.

QDS flagged earlier that S&P 500 option dealers are long ~$8bn of gamma / 1% move at spot and marginally longer on down moves (or about $10bn of delta demand with SPX at -1.4%), which can provide some intraday cushion to US equities...

...but levered ETF rebalancing flow is expected to be larger, given much of the levered ETF short gamma is benchmarked to Tech, which is underperforming. With NDX -2.3% and SPX -1.4%, levered ETF rebalancing supply is est. to be over $11bn today (with $8.5bn of that supply in NDX/Semis/Tech). $11bn of levered ETF supply would be in the top 50 largest days on record on QDS’s estimates.

What’s the credit market saying?

Spreads in High yield software and tech are both moving higher.

Further, as we detailed here, Goldman's Christian Degrasse notes that software loans make up ~16% of the leveraged loan markets.

KEEP AN EYE ON SPREADS HERE, as Goldman's credit team is noting that software’s ~16% mix of the leveraged loan market is similar to energy in ‘15/16, or Utilities post ’02.

Could we get a bounce?

The RSI of the Software sector is at 20 - massively oversold - the most oversold since 2018...

...but, as Goldman notes, flows continue to be skewed to selling with no buyers stepping in...

Software is by far the most $ net sold subsector across all sectors YTD. Software net exposure (as % of total US net MV) finished at a new record low of 4.2% (vs. 7% at start of 2026 and historical peak of 17.7%) last week.

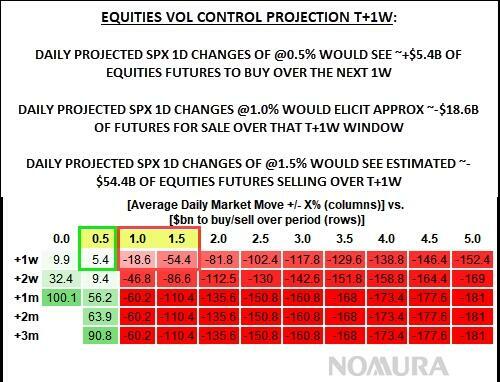

Flow-wise from here, Nomuras Charlie McElligott notes that Vol Control is a “de-risking flow” potential in the case of a sustained expansion in the Vol move, as currently 1m rVol (10.6 / 33%ile) and 3m rVol (29%ile) have just kinda languished sideways... not wildly low or ready for a shock per-se, but in the case we were to continue sustaining these iVol levels over the next week and 1d projected changes > 1.0% daily, there’s gonna be $exposure reduction (1% daily over next 1w = -$18.6B; 1.5% daily over next 1w = -$54B.4B over next 1w)

Goldman's top TMT Specialist, Peter Callahan, noted that the market moves were 'zero sum':

illustrative of high-single stock volatility and dynamic subsector rotations against a stoic index ….. YTD, the NDX is +30 bps (and ~50 names are up, ~50 names down) … on a 3-month look back, the NDX is -2% (and exactly, 50 names up, 50 names down). Still feels like a lot of single-stock & subsector vol, but not much movement at and index level as rotational trading continues …

Callahan also suggests 'where to go'

Fair bit of tension out there on ‘where to go’ / ‘what is durable’ as pockets of the long-side look a bit extended to the upside (if only judging by RSIs or YTD performance)...

...whereas, names on the under-side of the portfolio also appear stretched to the downside (yes, lots of SMID/Large-caps down 10-30% YTD).. as such, perhaps not overly surprising to see GARPy or Quality names start to bounce a bit – think: WMT or ADI or CSCO or AAPL or MA in recent days …. Something to watch (and, a thread to pull at to try and expand the list of ‘durable’ long ideas).

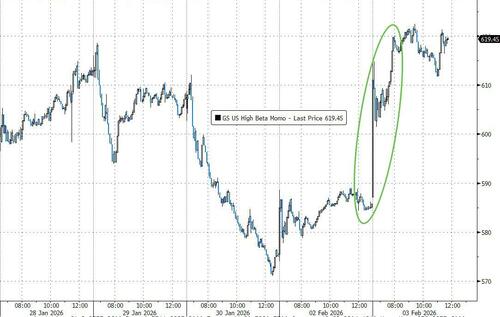

One potential avenue for flows is the rebound in momentum stocks,which were at the top of the leaderboard today...

Goldman recently highlighted the correlation between Momentum and Gold is at multi-year highs which is driven by the surge in mining stocks.

The Metals and Mining Industry is at the highest weight in their Unconstrained Long/Short Momentum in years.

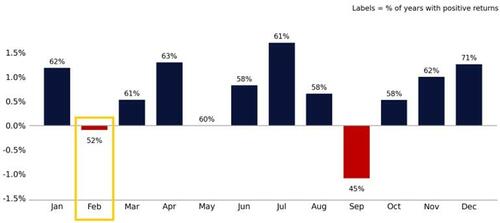

Finally, as we detailed yesterday, historically, February has been the second weakest month of the year, with the S&P 500 averaging -9bps since 1928 and posting the second-lowest hit rate of any calendar month.

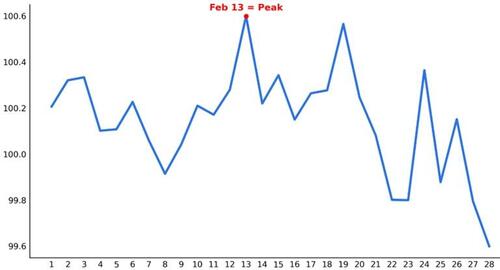

2H February has historically seen more uneven price action, with early gains often giving way to consolidation or pullbacks as early-year positioning settles.

Which is one of the reasons behind Citadel's Scott Rubner's call that he has "higher first, then lower vibes for US equities" in February.

Professional subscribers can read much more from Goldman's Sales & Trading team here at our new Marketdesk.ai portal