No Country For Old Macro

By Russell Clark of Capital Flows and Asset Markets substack

I turned 50 early this year - but like most men still think I am young. It only really hits home that I have aged when I catch up with a group of friends the same age. Sometimes its the grey hair, sometimes its the bald spots, or sometimes its the universal doom and gloom about markets, and I think “Wow - I am really hanging out with a bunch of old guys!” Having a doom and gloom view about markets really does show your age. Talking about the year 2000, 2001, 2002 or 2008, which were bad bear markets just dates you these days. In the big scheme of things, they were just buying opportunities.

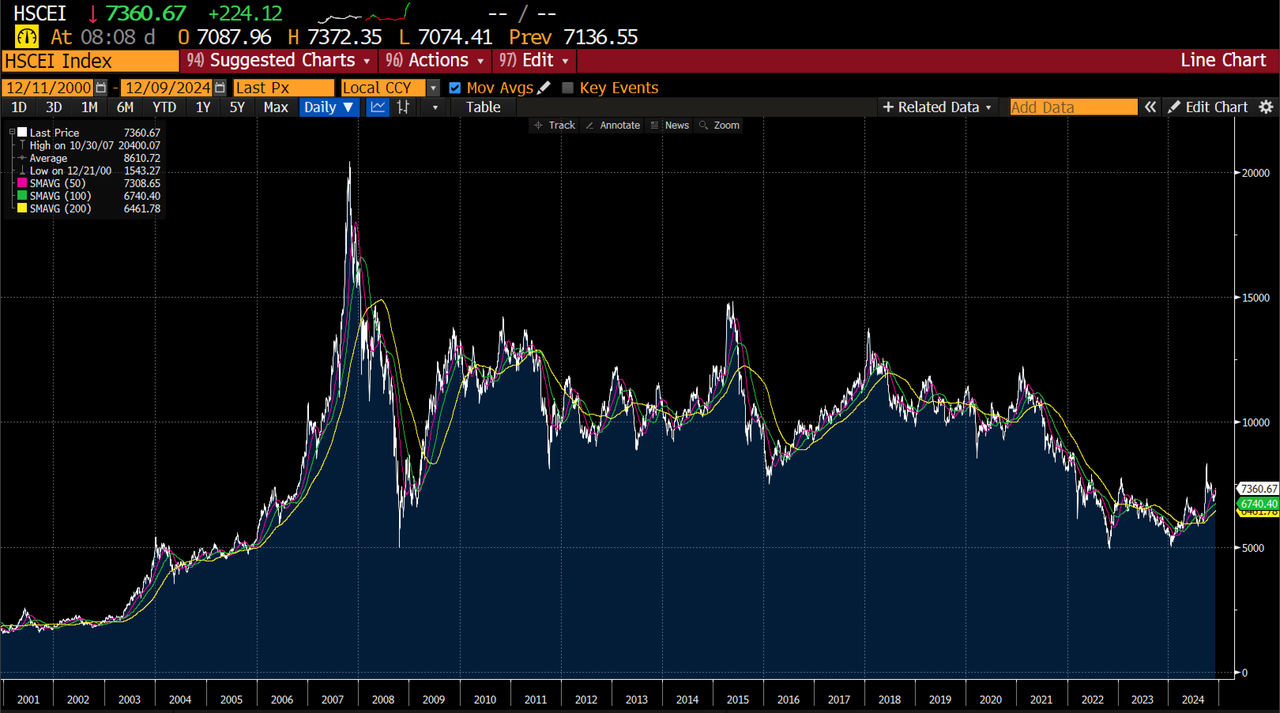

Having started in markets in that period, and having seen the long depressing Japanese bear market - I was always more “old man” in my thinking - but being stuck in your ways when the world changes is the ultimate old man trade- like insisting and old Nokia phone is better than iPhone. To be fair to myself and other old men - around 2007 I though China and emerging markets was dead money (and foolishly assumed this would hold back the US). HSCEI is not even at half the level it reach in 2007.

My first investing model was the MMM model - macro, micro and market, and it was pretty good at calling the top in China and emerging markets. Macro was current account deficits, exchange rate and money supply among other things, micro was how key industries were acting and investing their own capital. Market was basically investing when market action confirmed micro and macro. The good thing about this model was that it could be used for long and short investing.

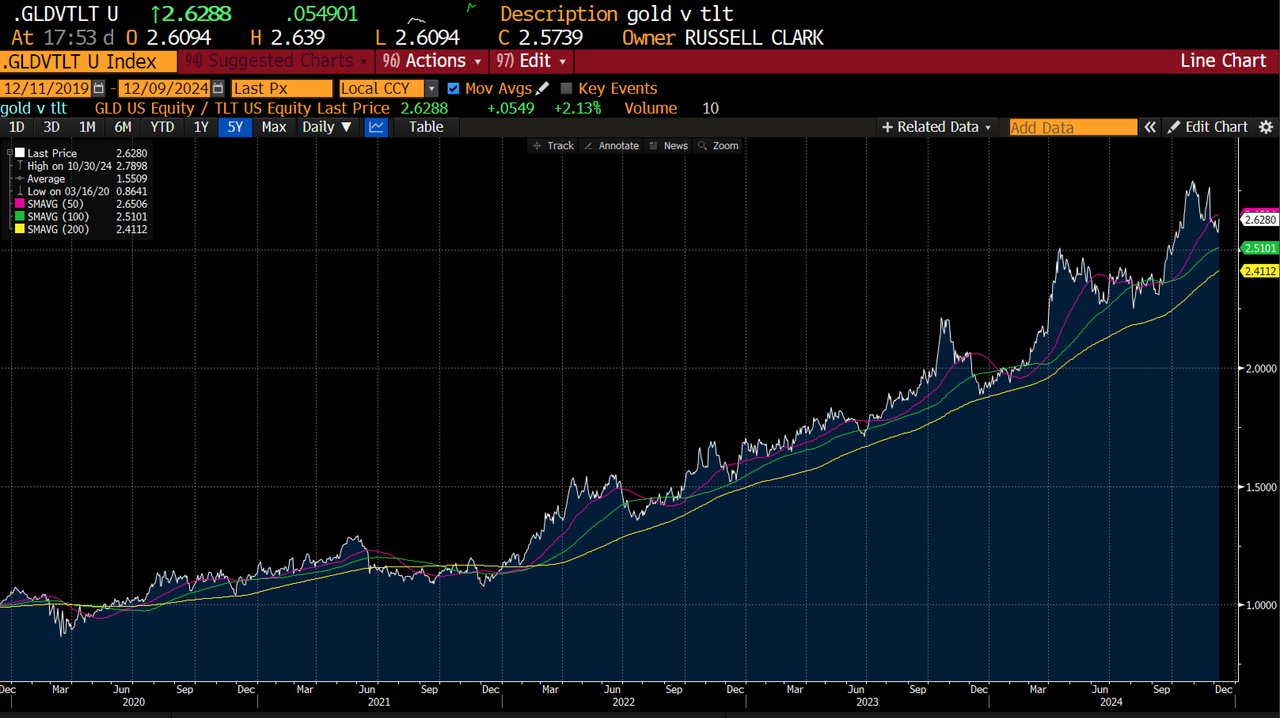

The macro part of my MMM model turned negative on the US back in 2016 - some 200% and 8 years ago. It also turned negative on the US dollar - so you cannot dress it up - its a failed model. I tied to save this model by adding a political element to it - which I called motivation so I could call it the MMMM model. This birthed the pro-labour trade - and GLD/TLT as well. While GLD/TLT has been good - it also made predictions about asset markets being stagnant, or at least US dollar weakness. This has been wrong.

As I have been contemplating these failed models, I have also been ruminating on ideas of empire, the rise of a digital world, and tech for awhile - and have started to think we can fold “old school macro” in to tech and industry analysis, which would create a model that explains the modern world. What I have been thinking about is the vast technological change we are undergoing at the moment, and what precedents we have to think about. 100 years ago the US birthed the auto industry as we know it. This fundamentally changed society - but also changed the US place in the world. US industry quickly dominated the auto industry - and the US became the dominant nation.

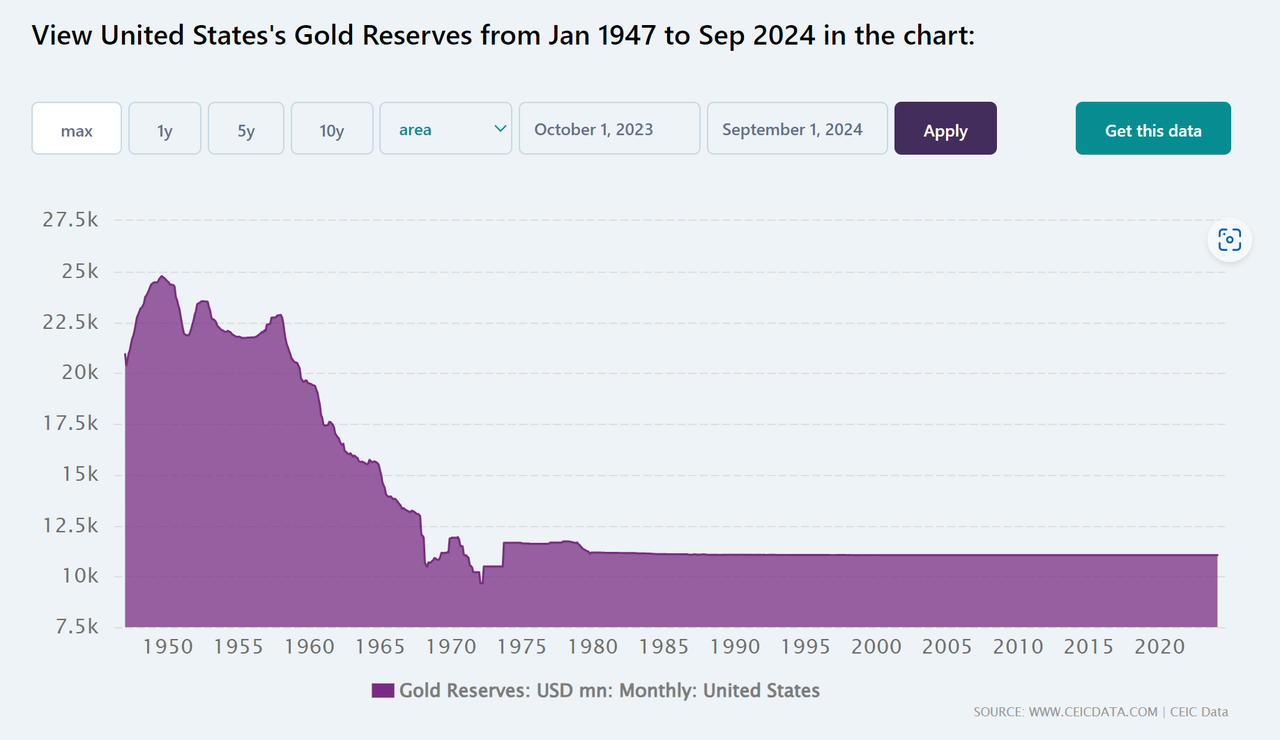

Post World War 2 - US dominance of the the most important industry in the world - the auto industry- was coming under threat. FDR led unionisation of the auto industry led to US firms becoming uncompetitive and suffering at the hands of German and Japanese auto firms. This led to a US trade deficit and falling gold reserves. The US left the gold standard - and modern day macro investing was born. With the gold standard, making predictions on currency or interest rates were largely unnecessary - fiat currency created the conditions for macro investing.

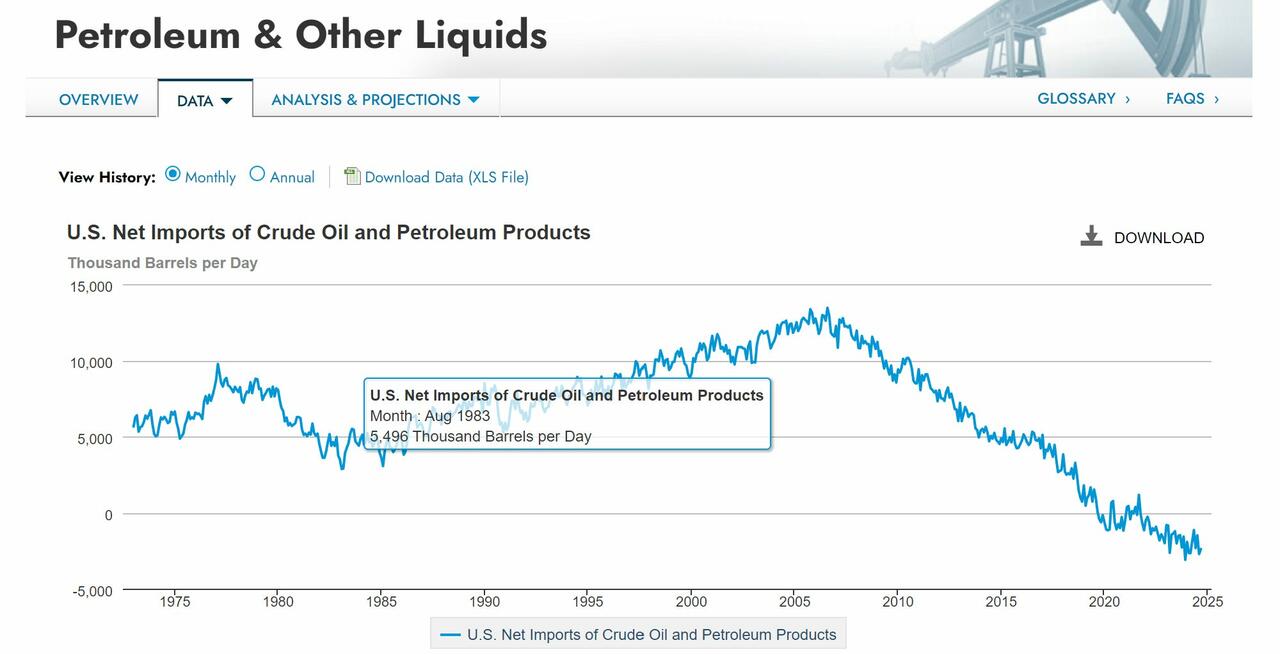

The auto industry is generally estimated to be 10 percent of GDP for most nations, running from manufacturing, repair, sales and financing, but you could also include things like road maintenance and repair. From 1960 onwards, not only was the US importing cars, but the crude oil to run them. Japan, Germany, Saudi, Canada and Mexico all grew wealthy (some more than others) on the back of supplying US auto industry one way or another. However over the last ten years changes in technology has changed all of this. First of all, the shale revolution has made the US is energy self sufficient - which destroys the connection between US growth and energy suppliers. That is a booming US does not necessarily make Canada or Saudi wealthier.

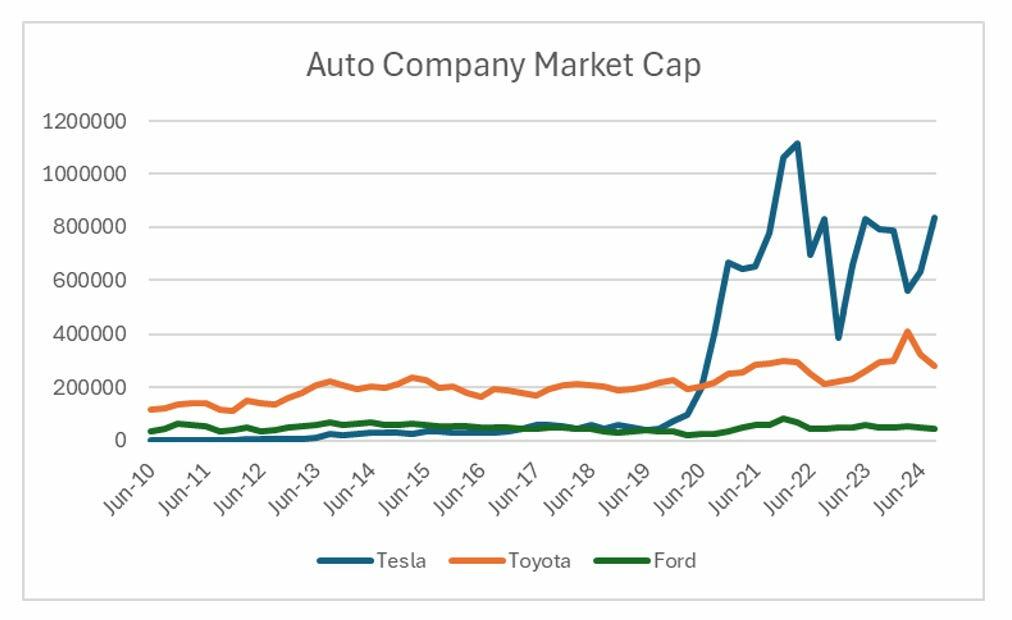

Secondly, with the world moving to electric vehicles - the US has the leading company in Tesla. For decades, Toyota was worth more than Ford, the leading US car company. But since 2020, Tesla has been far more valuable than Toyota. The traditional conduits via which US growth is spread to the rest of the world have been or are in the process of being cut. Industry analysis has eaten macro analysis, or at the very least changed it completely.

Another feature of Western dominance and now mainly US dominance is a political system that allows the masters of new technology to assume political control. The ability to absorb the masters of new technology into the political system is underrated feature of the West- mainly because the existing old order bitterly resent it. A typical old man gripe would be about the new wave of populist leaders. But one thing common about populist leaders is that they are much more effective on social media. What is interesting about Trump Mark 2.0, is that social media, and new tech leaders have lined up with him, far more than in his first term. Politically, it is hard to see how bringing in the new leading industries into the political world is a bad thing for the US. You can compare and contrast with Volkswagen that is facing a existential crisis, and has to deal with state government owners wishing to keep old engine factories open.

One of the best university courses I did was called “Asian Giants” and compared and contrasted how India, China and Japan dealt with the Western Powers and their Asian colonialism. India just accepted them as another ruling class - and eventually saw deindustrialisation as British rulers saw no need in encouraging competition. China rejected all Western influence - and saw its nation carved up by Western powers, while Japan embarked on a process of modernization - which saw traditional leadership move from the samurai class to the merchant class. Within 20 years Japan had kicked out the foreigners and began to build its own empire. Japan also had to go through a violent political reconfiguration - the Meiji Restoration - but ultimately a strong Japan was achieved.

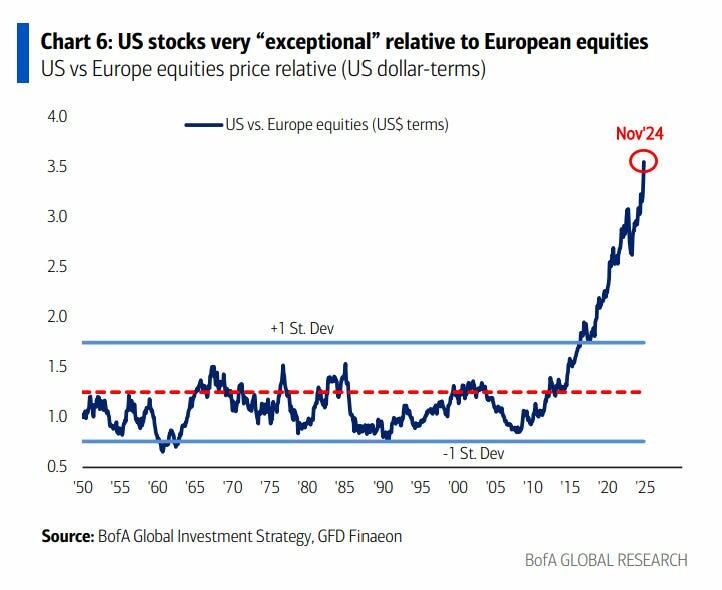

One of the things that “old men” often fixate on is the dominance of the US in equity markets. Many, many macro careers have been destroyed by trying to catch a mean reversion trade, that is betting on emerging market or Europe rather than the US.

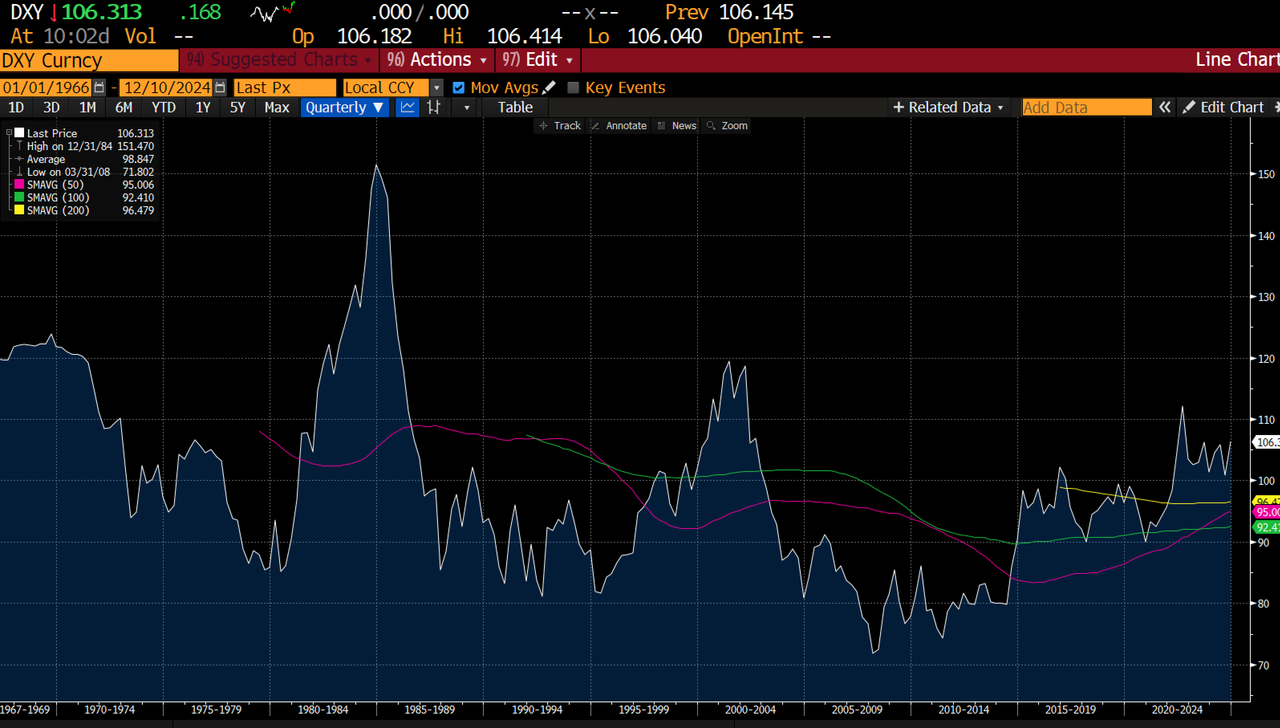

But this chart is driven by two big technological trades. First modern cloud computing means that the need to use local companies for anything is unnecessary and pointless. Economies of scale drive everything to the US (he says as he uses San Francisco based Substack and Stripe - while writing a note on macro investing while in Spain). This is different to say the mobile phone boom in 1999, where Vodafone was the largest stock in the UK. The second feature is that the US and China have stolen a march on Japan and Europe in electric vehicles. This reliance on lagging technology is probably why the Euro and Yen has been such poor currencies, and why the US dollar has been strong. Chinese Yuan has been also better than Euro or Yen. This probably explains why currency has also been the other killing field for macro investors. Short dollar trades have been very poor.

Putting it all together, from a tech perspective China is the only threat to the US. Japan and Europe have missed the boat on cloud and social media tech, and are badly compromised on EV, while China is competitive in both these areas. On drone technology, which modern warfare seems to be based, China is probably ahead of the US. For me, we are now at an interesting political, tech and macro crossroads. Chinese and US politics has diverged radically on tech. In the US, we have Elon Musk as best buddy to Trump, and big tech is close to big power. In China, they have chosen to regulate tech move heavily, and encourage far more competition. This has led to the Chinese Yuan outperforming Euro and Yen, but not translated into better equity performance.

Macro trading, as far as this old man now understands it, was the result of US technology propagating across the world, and in some cases, like Germany and Japan, taking this technology and improving it. This led to shifts in currencies, interest rates and growth rates. But new technology has led to a shift back to the US. In areas like cloud computing or social media, its hard to see that shifting back to Europe or Japan without government intervention. In EV, we can see that China has probably already stolen a march on Europe and Japan, and is already squeezing Tesla in China. China already has used government intervention to keep cloud computing and social media in domestic hands. Using tech changes to think about macro changes means I think we only see big changes in markets when Europe and Japan get serious about industrial policy. For that, they need strongman politicians, and not the lawyer/banker politicians we have now.

That transition is beginning in my view (Germany, France and Japan all going through political transitions). As my university course taught me, the country that can break down the old industries to allow new industries to thrive will be the ones to buy. Macro is a now a tech and political question - something old macro investors are not good at. There is no country for old macro.